Tax Strategies

Tips to help you save on taxes & give more to causes care about.

Tax Strategies, Giving

Your Charitable Deductions Tax Guide (2024 & 2025)

Maximize your tax savings and charitable impact in 2024 and 2025 by understanding the latest IRS charitable contribution limits, donation rules, tax strategies, and more.

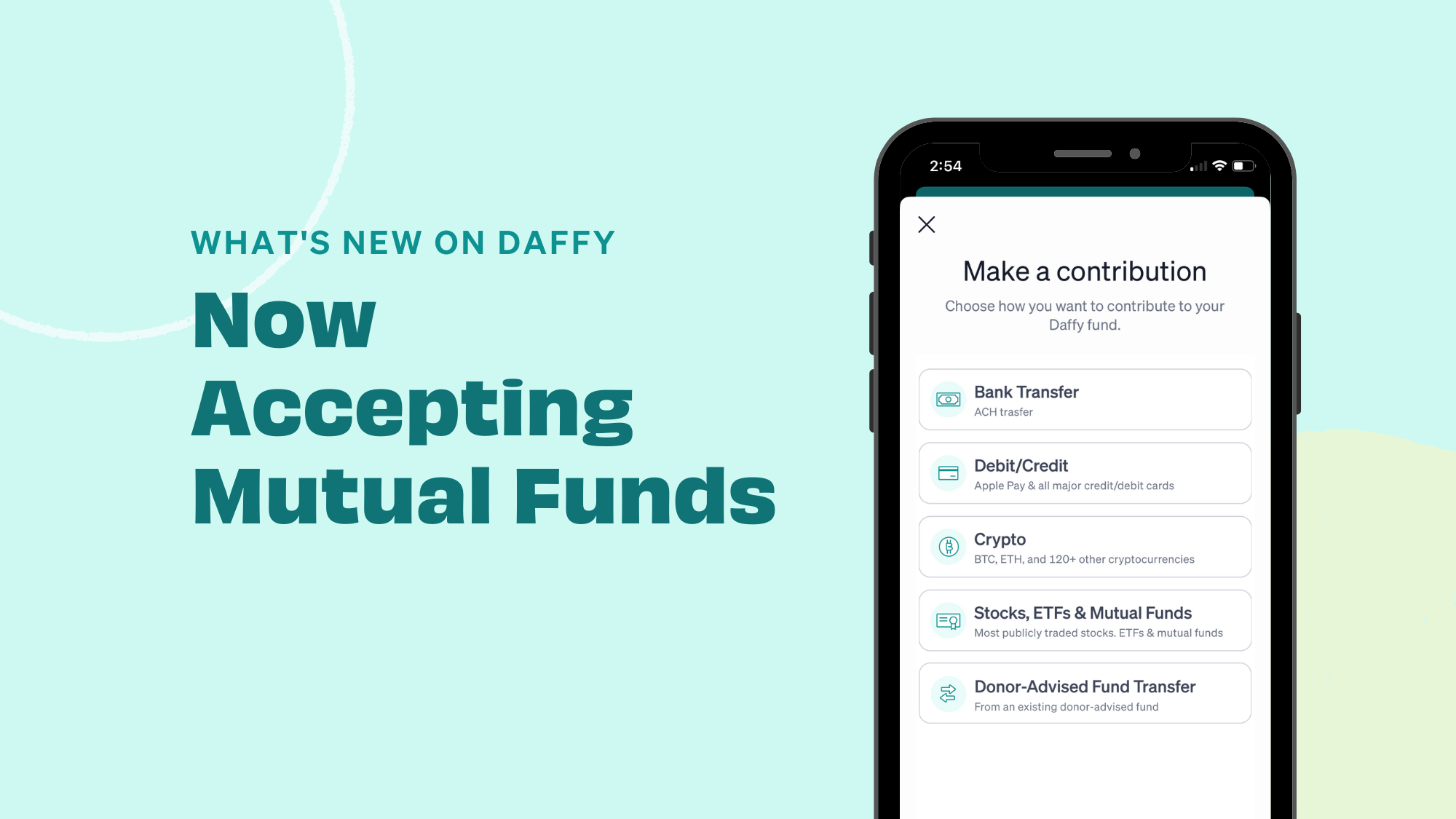

What's New on Daffy, Tax Strategies

Got Mutual Funds? Here’s How to Boost Your Giving & Save on Taxes

We now accept mutual fund contributions on Daffy, so that you have more ways to maximize your giving.

Tax Strategies

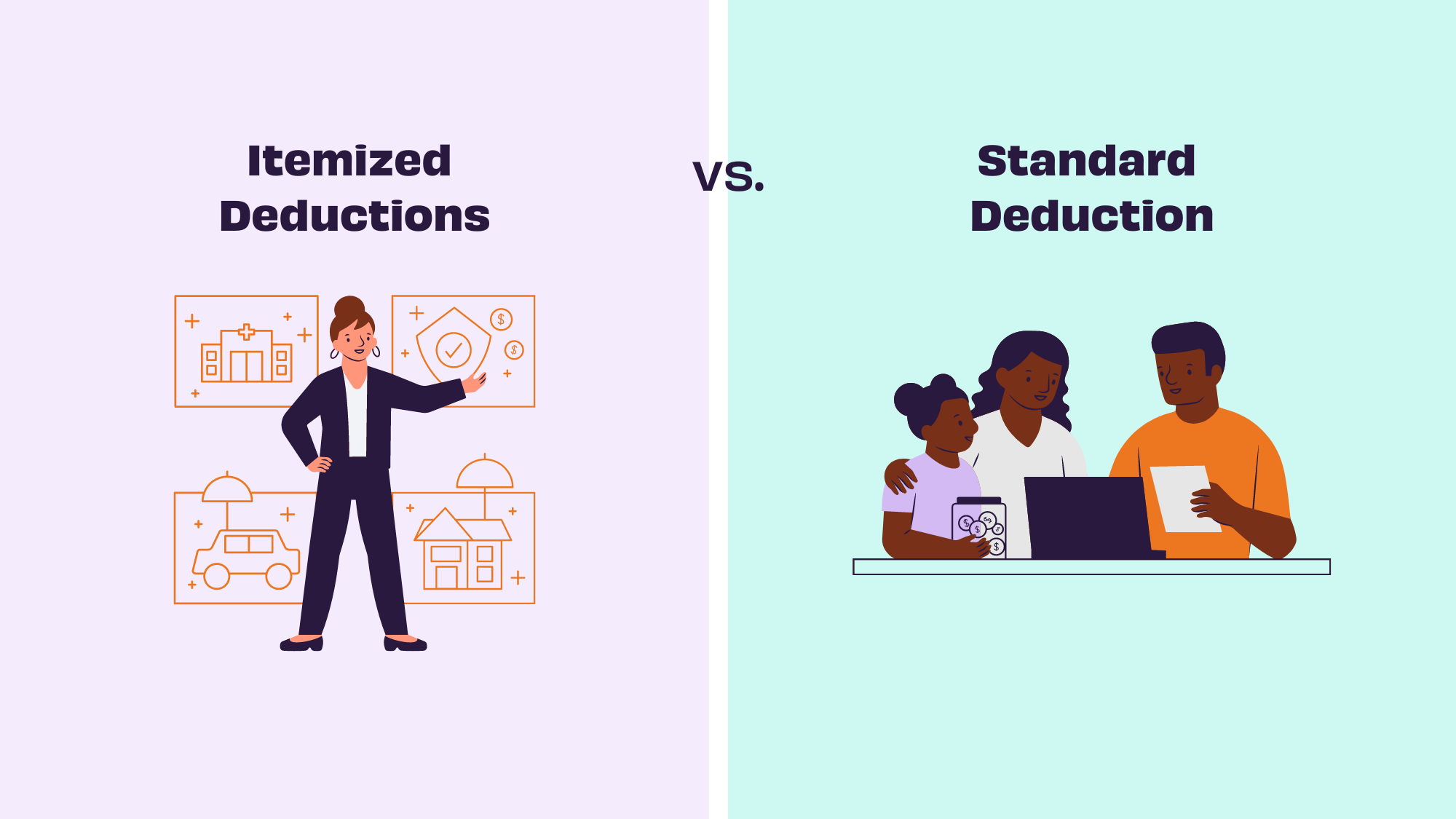

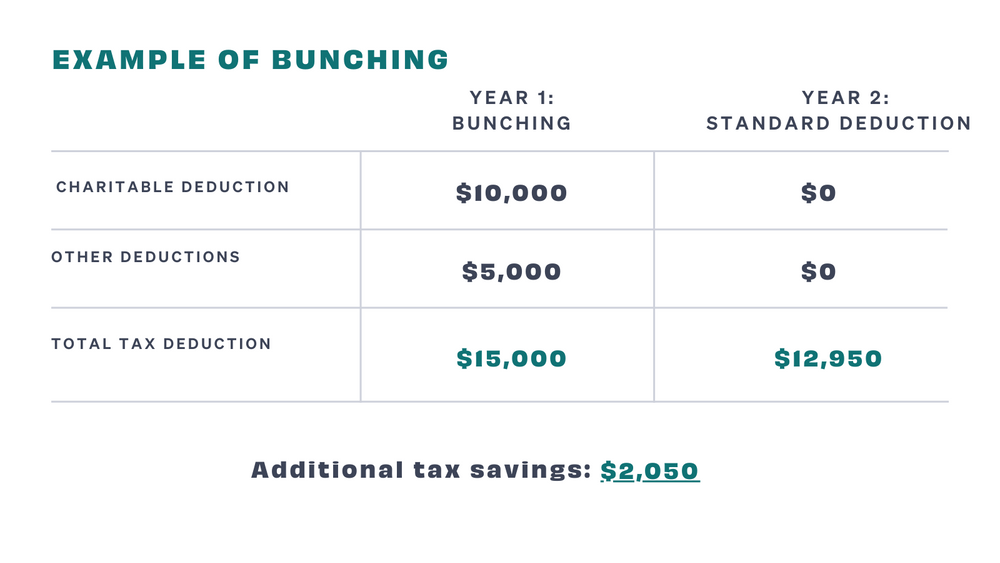

If You Give to Charity, ‘Bunching’ Could Save You Thousands

By using a donor-advised fund and a simple tax strategy called “bunching,” taxpayers who don’t normally qualify for itemized deductions can access the charitable deduction.

Tax Strategies

Why You Should Always Donate Stock Instead Of Cash

Long-term investors who donate stock instead of cash can save on capital gains taxes while maximizing the benefits of giving back.

Tax Strategies

How to Claim Charitable Contributions on Your Tax Return

Find out which IRS forms you need in order to itemize your charitable contributions on your taxes every year.

Tax Strategies

Nervous About Crypto Taxes? Donate Your Profitable Holdings Instead

Donating appreciated crypto to charity can result in tax savings for you and more money for charities.

Tax Strategies

Want to Save on Taxes? There’s a Better Way to Rebalance Your Portfolio

Long-term investors who engage in charitable giving can save on capital gains taxes by donating shares when they need to rebalance their portfolio.

Tax Strategies

Donating Regularly to Charity But Not Itemizing? A Tax-Smart Giving Strategy You Should Know

This tax-smart strategy helps you deduct your charitable contributions even with a higher standard deduction.

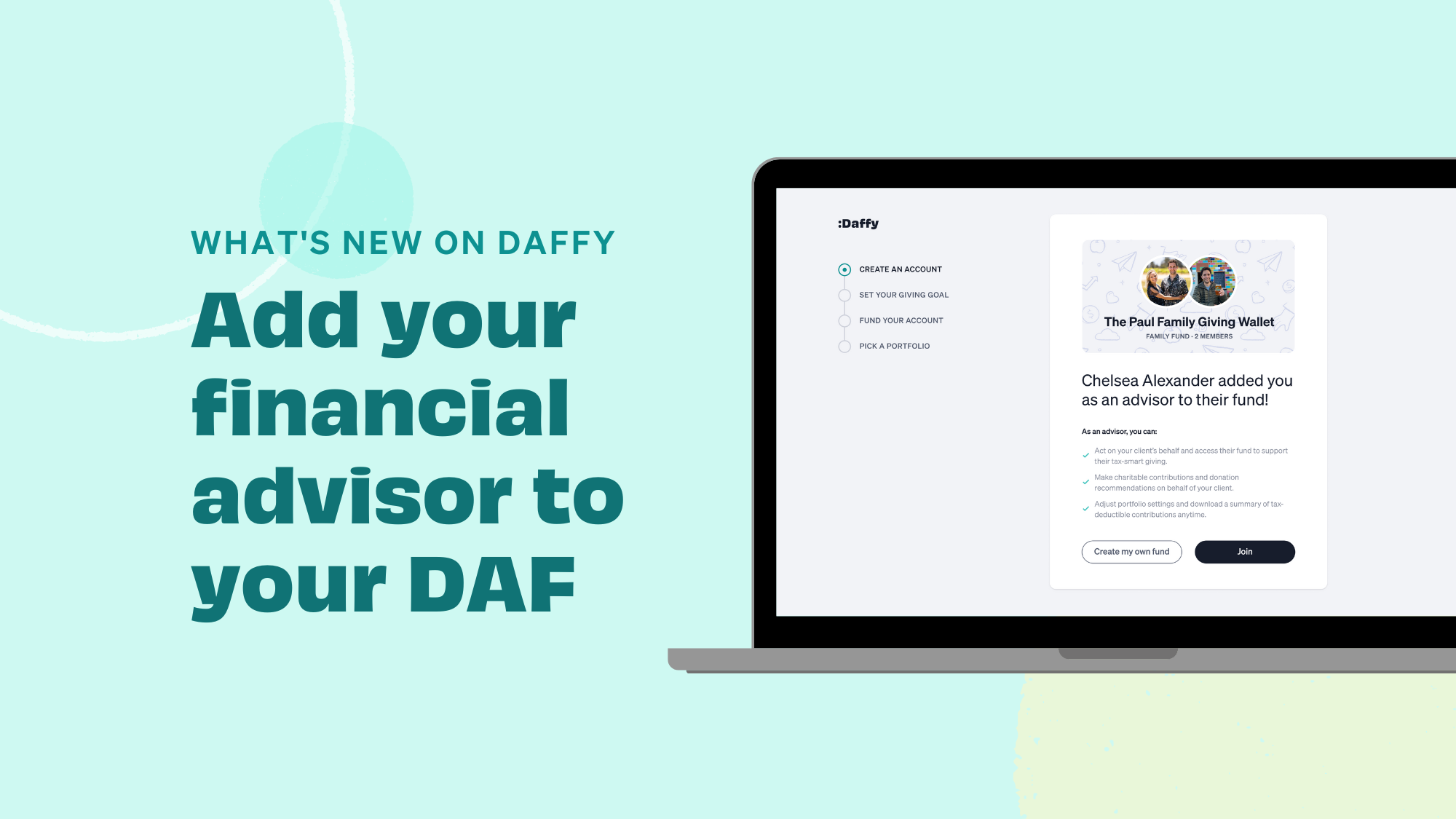

What's New on Daffy, Tax Strategies

You Can Now Add Your Financial Advisor to Your Donor-Advised Fund on Daffy

Daffy members can now add their financial advisors to their Daffy fund, making it easier for advisors to help you strategically manage your fund as well as tactically take actions on your behalf.

Tax Strategies

4 Tax Mistakes to Avoid When Making Charitable Donations

Instead of leaving money on the table at tax time, learn how to skip these common tax mistakes and lower your tax bill.

Tax Strategies

Charitable Tax Deductions: 4 Things You Need to Know

Find out how to write off up to 60% of your AGI, take advantage of the increased standard deduction for 2023, and uncover commonly overlooked tax breaks.

Tax Strategies

How Donating Stock to Charity is a Win-Win For You & Charities

Giving stock instead of cash as a charitable donation can greatly benefit you as well as the non-profit.

Tax Strategies

How to Maximize Your Tax Savings by Bunching Charitable Donations

Not sure if you should itemize this year? Check out this charitable deduction strategy to help.

Giving, Tax Strategies

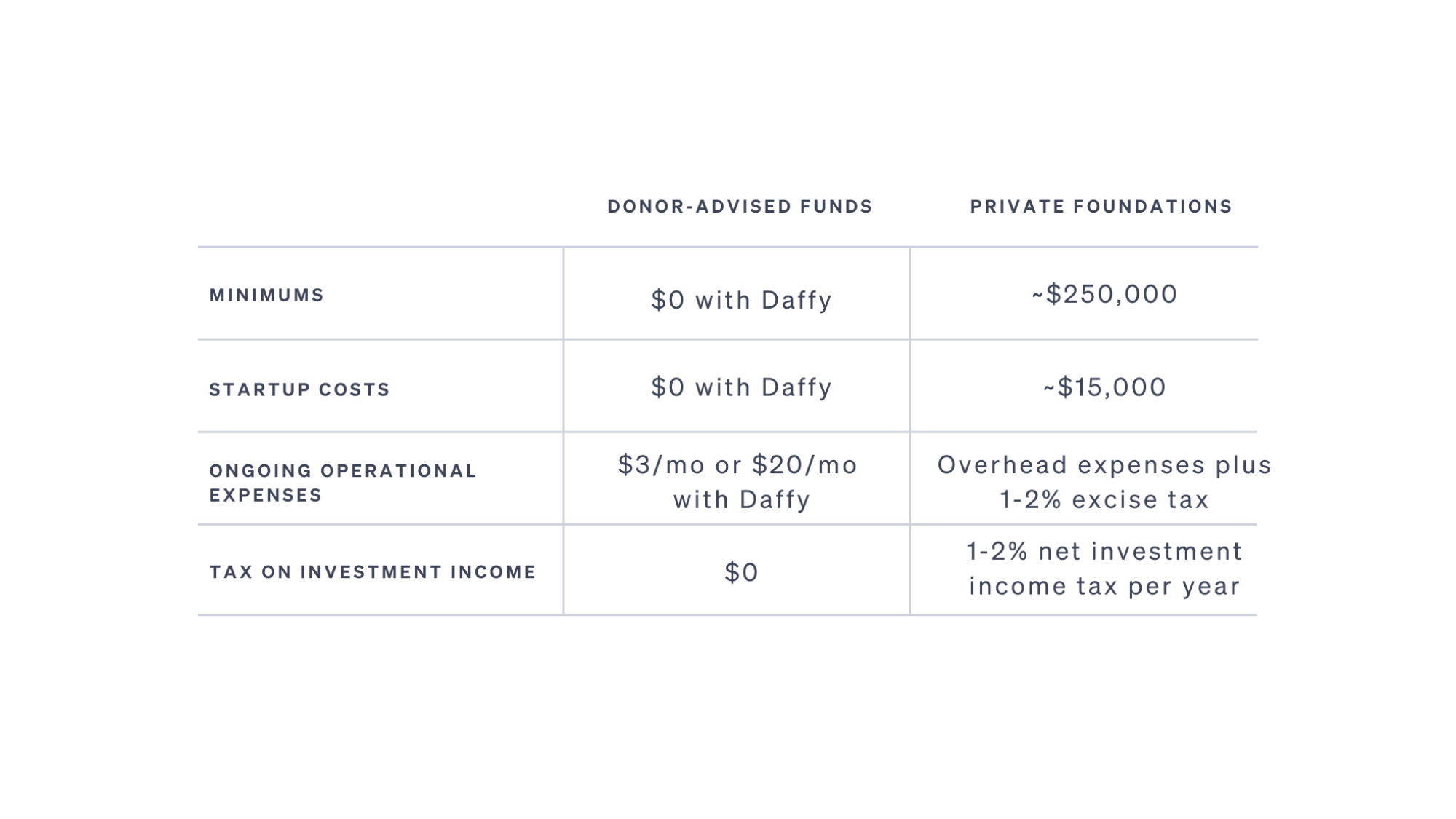

Donor-Advised Funds vs. Private Foundations: What’s Best For You

While both options offer the potential for tax savings, there are several major differences between the two. You’ll maximize your impact and save yourself tons of time.

Tax Strategies

6 Smart Ideas for What to Do with Your 2022 Tax Refund

Further your financial goals by putting your tax refund to work.