With the Tax Cuts & Jobs Act (TCJA) passed in 2017, taxpayers got a much more generous standard deduction. However, this also means fewer people will have access to their favorite tax deductions like charitable giving since the threshold for itemizing is much higher.

However, there is a strategy to help people who don’t normally get to itemize their deductions get access to the charitable deduction. It’s called “Bunching” (sometimes called "bundling") and it’s something you should know about if you give to charity regularly.

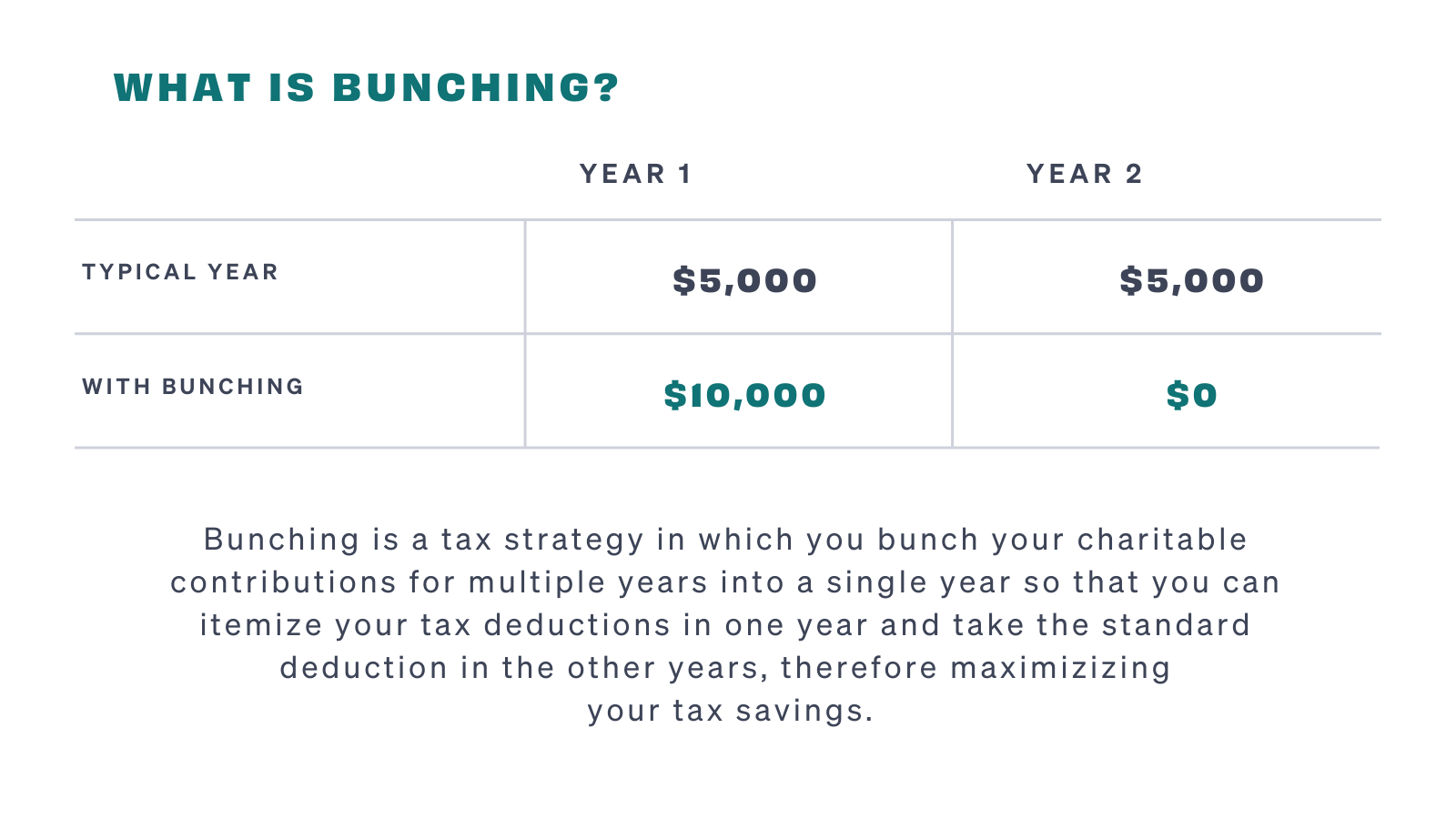

What is Bunching?

Bunching is a tax strategy in which you group your charitable contributions for multiple years into a single year so that you can itemize your tax deductions in one year and take the standard deduction in the other years, maximizing your tax savings.

In 2022, the standard deduction for individual taxpayers is $12,950. For taxpayers who are married and filing jointly, the standard deduction is $25,900. That means it doesn’t make sense to claim a charitable contribution as a tax deduction unless you exceed the standard deduction. This is where bunching can help. The goal is to donate enough funds so that you can itemize your tax deductions instead of taking the standard deductions.

For instance, a single tax filer who wants to give $5,000 a year to charity isn’t close to reaching the $12,950 standard deduction threshold. To get closer, they could double that amount by bundling two years of contributions in one tax year. That would amount to $10,000 and then they can easily reach $12,950 with other common tax deductions, like mortgage interest.

Look at the Bunching Strategy in Action

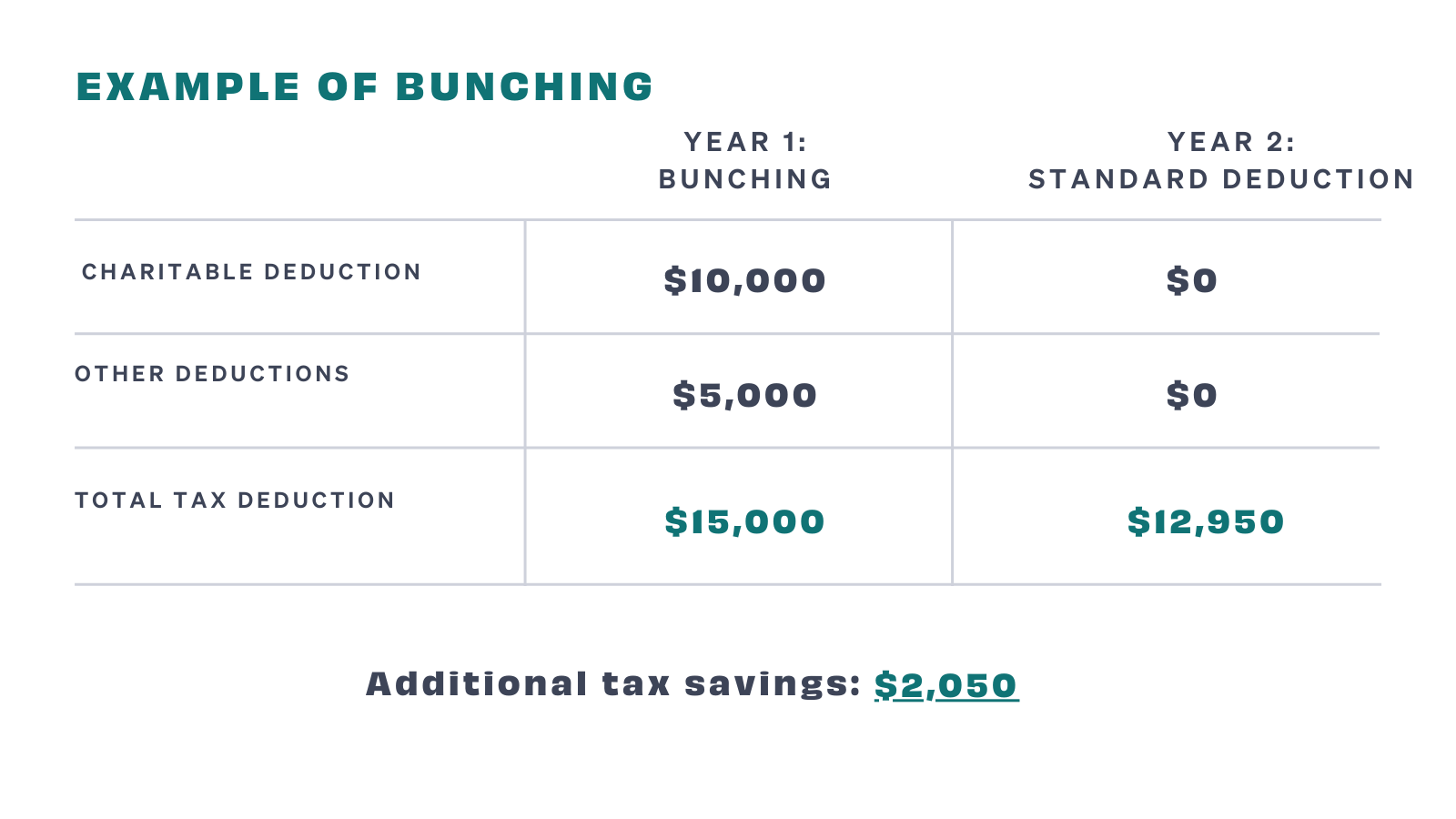

Take a look at how donation bunching works in a hypothetical scenario. Let’s say Leah works in sales at a major software company. In January, she received a $50,000 commission bonus for sales made in the previous year, which qualifies for the 22% federal tax rate. That adds $11,000 to her total tax bill for the 2022 tax year. But charitable giving is also important to Leah, and she tries to set aside money for donations to her favorite non-profit organizations when she can.

Donation bundling can help Leah save money on her taxes and help those non-profits at the same time. Leah uses Daffy and makes a $10,000 contribution with some of the funds from her bonus. That sounds like a lot, but over two years, that amounts to donating just over $400 each month.

Plus, Leah doesn’t have to give the money to any charities yet; instead, she can invest those funds with tax-free growth and spread her contributions out over the next two or three years.

On the tax front, Leah’s $10,000 charitable contribution paired with the $5,000 she’ll pay in mortgage interest on her condo should put her well above the standard deduction; in fact, she’ll get to deduct an extra $2,000 from her taxable income while also making a difference in the world.

When to Bunch

Bunching charitable contributions isn’t right for everyone, but it can make a lot of sense for some people. This strategy can be done in any year but could be even more effective when you have extra income. Here are common scenarios when it might be a good option for your own tax strategy.

- You have a major increase in your taxable income, such as stock sale, crypto gain, large bonus, or inheritance.

- You are close to being able to itemize your tax deductions.

- You want to make a large donation to a charity or cause you care about.

Giving more in one year helps you to significantly lower your taxable income. Then you can wait another year or two before you make any more contributions.

How to Bunch

Charitable bunching doesn’t mean you have to rush to make a decision on how to distribute your funds. Instead, use a donor-advised fund (or DAF) to invest that money and then release your contributions when you’re ready. Just transferring funds into your donor-advised fund triggers the tax deductions even if you wait to choose specific non-profit organizations to support.

With Daffy, you can add funds and select from a variety of investment options, including stocks, bonds, and cryptocurrency. When you’re ready to make a contribution to your favorite charity, simply donate directly through the app using your existing funds. Plus, your donation may be worth even more if your investments have grown, and you don’t have to pay tax on the gains. Daffy also makes tax season easier since all of your giving history and tax-deductible contributions are in one place.

Ready to bunch your contributions for major tax savings this year? Join Daffy today.

Please note that the information contained on this page is for educational purposes only and should not be considered tax or investment advice. Any calculations are intended to be illustrative and do not reflect all of the potential complexities of individual tax returns. To assess your specific situation, please consult with a tax and/or investment professional.