This piece was originally published on Coindesk on April 17, 2023.

2023 feels like the year that the US government got more serious about crypto, and with recent actions by the SEC, CFTC, and IRS, you can’t blame most investors for feeling a little nervous when filing their 2022 returns.

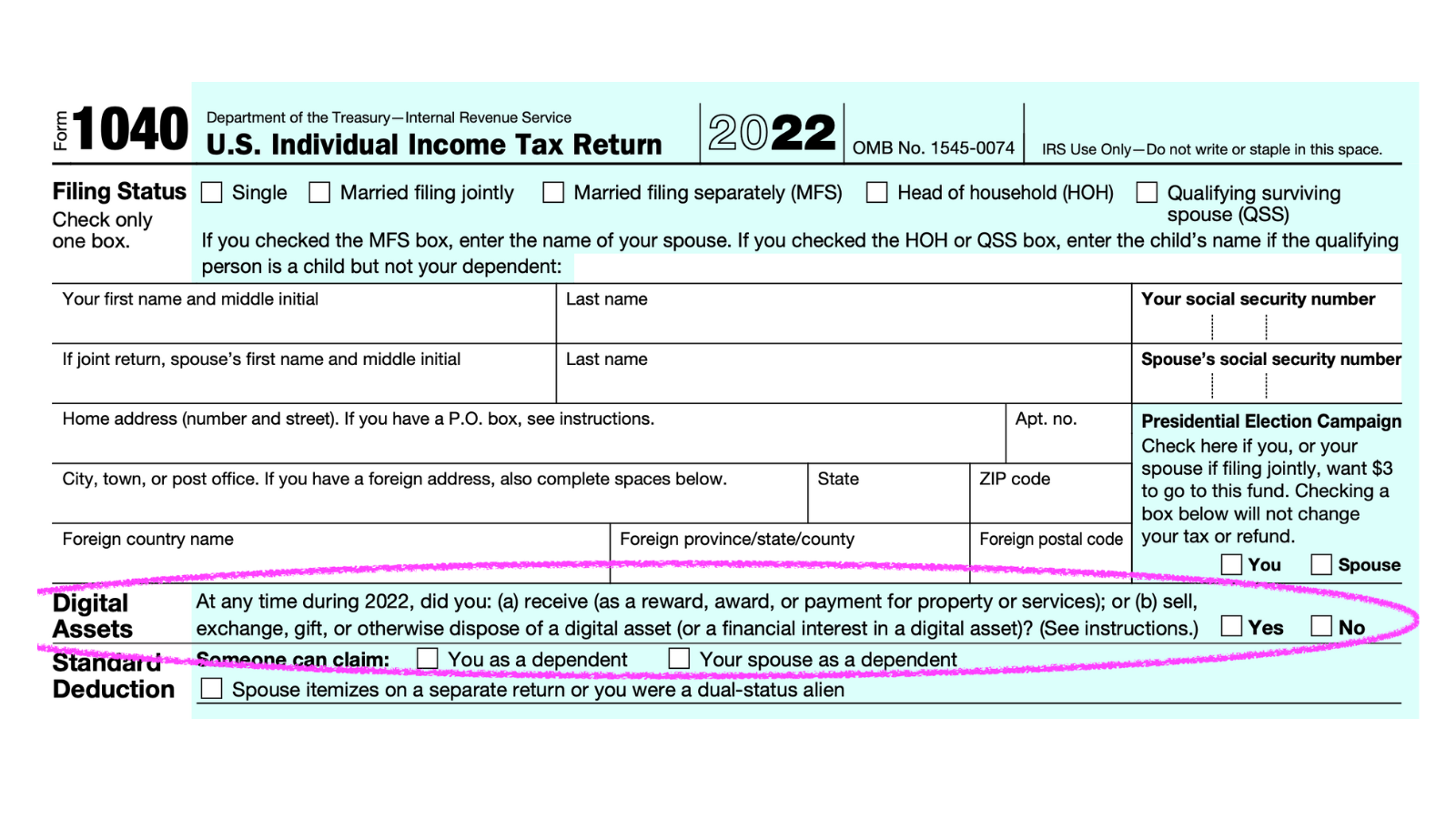

Crypto taxes can be confusing, even for experts in the industry. But if there was any confusion about the need to pay taxes on your crypto investments, that changed in 2020 when the IRS added it to the front page of Form 1040. As a result, many taxpayers are anxious about making sure they report their crypto taxes correctly.

While there may be some debate between the SEC and the CFTC on how to regulate crypto, the IRS treats cryptocurrencies like stocks, bonds, and other capital assets, and most types of crypto transactions are taxable events. So if you sold, converted, spent, earned, or staked crypto, for example — you’ll need to report your gains and losses to the IRS.

Unfortunately, without a standard 1099, it’s not surprising that many crypto investors have some level of dread and anxiety about potential tax issues with the crypto they hold. Now that the IRS is much better funded, the penalty for even honest mistakes feels higher.

There is another reliable and legal way to avoid these issues: charitable donations.

If you are fortunate enough to hold crypto that has appreciated in value for more than one year, you can donate it. You won’t need to worry about paying capital gains taxes and you’ll reap the benefits of one of the most generous deductions in the tax code.

Start giving and saving more with Daffy.

Understanding Crypto & Taxes

As per the IRS guidelines, crypto and other digital assets are classified as property (like stock) and cryptocurrency transactions are subject to capital gains taxes:

- Crypto held less than one year: If you hold your crypto for 365 days or less, any appreciation is subject to the short-term capital gains tax, which is the same rate as income taxes.

- Crypto held more than a year: If you hold your crypto for more than a year, then your investment gains qualify as "long-term," which generally offers lower tax rates.

The length of time you have held an asset is very important when it comes to donating assets. The IRS has very different rules for assets that have been held short-term vs. long-term:

- Donating crypto held less than a year: If you hold crypto for less than 365 days, then the IRS limits your deduction to the fair market value of the asset minus the capital gain. As a result, donating assets like stock or crypto that have been held for less than a year makes very little sense. If it is below your purchase price, you would lose out on claiming the capital loss. If it is above your purchase price, you lose out on the value of the gain.

- Donating crypto held more than a year: When you donate crypto that you have held for more than a year to a qualified public charity, the IRS considers the donation value to be the fair market value of the asset at the time. Not the value you paid for it — the current fair market value.

If you itemize your tax deductions, this means donating appreciated crypto can result in money saved for the taxpayer and more money for the charity. The charitable deduction is one of the most generous in the tax code, allowing the taxpayer to deduct donations of assets up to 30% of their adjusted gross income (AGI) in any given year.

Saving Thousands of $ on Crypto Taxes

When it comes to crypto and taxes, sometimes a simple example can help illustrate how this simple strategy could work.

Imagine a couple that has an adjusted gross income (AGI) of $250,000 per year who purchased a Bitcoin in Feb 2020 for $10,000, and then decided to sell it in April 2023 for $30,000.

In a state like California, a couple earning $250,000 might be in a 15% federal tax bracket for long-term capital gains in addition to a 9.3% California tax bracket, for a total of 24.3%. Since that couple purchased BTC at $10,000 and then sold it for $30,000 after holding it for more than a year, they would owe a total of $4,860 in taxes on a reported gain of $20,000, leaving them with an after-tax gain of $15,140.

Of course, they could lighten this tax bill by donating the proceeds of the sale to charity. The couple, assuming their total income tax rate is 33.3% (24% for federal tax and California’s 9.3% state tax rate), could make a cash donation of $25,140 to get a tax reduction of $8,372.

However, the numbers are much better for our couple and the charities they support if they donate the bitcoin directly. Donating 1 BTC with a fair market value of $30,000 to charity would allow the couple to deduct $30,000 off of their income. At their 33.3% tax rate, that would potentially save them $9,990 in taxes.

So how much does the generous couple save? If they sell the Bitcoin and donate the proceeds, they could get a tax benefit of $3,512. If they donate the bitcoin, they could get a tax benefit of $9,990. That's a difference of $6,478!

By donating the bitcoin directly, the generous couple wins twice because they (1) get a tax deduction for the larger donation, and (2) they never have to pay capital gains taxes on the appreciation of their bitcoin.

But here is the amazing part: The charity wins too! In the first scenario, if the couple donated the proceeds to charity, they would have only been able to donate the proceeds of the sale: $25,140. However, in the second scenario, the couple donated a bitcoin worth $30,000. Since the not-for-profit organization does not have to pay taxes, they get the full benefit of that $30,000 – a 19.3% larger gift!

How to Donate Your Crypto

If you donate to charity regularly, the benefits of donating crypto are incredibly compelling from a tax perspective. Unfortunately, there are two issues that often come up when people try to donate their crypto to charity:

- Most Charities Don’t Accept Crypto. While there are a number of companies working to enable charities to accept crypto donations, most still do not. In fact, out of the over 1.5 million registered charities in the US, only a few thousand accept non-cash donations like stock or crypto.

- Most Charities Prefer Recurring Donations. The problem with donating crypto directly to a charity is that it’s a one-time donation. If you, like most people, support charities with a certain amount of money every year, you may not want to make a single large donation.

Fortunately, donor-advised funds (DAFs) like Daffy effectively solve both of these problems. A good donor-advised fund will accept crypto contributions and let you invest the proceeds of that donation tax-free until you are ready to recommend a grant to a specific charity. Some donor-advised funds even offer pure crypto portfolios, so you can keep your fund invested in crypto while you decide what organizations to support.

Donate Your Crypto & Worry Less About The IRS

No one can fault a person for having some anxiety about filing taxes about crypto transactions. But given the incredible benefits to both the taxpayer and the charities they support, more people should consider opening up an inexpensive donor-advised fund that supports crypto, and then donating their crypto to charity instead.

Your 1040 will thank you.

Please note that the information contained in this piece is for educational purposes only and should not be considered tax advice. Any calculations are intended to be illustrative and do not reflect all of the potential complexities of individual tax returns. To assess your specific tax situation, please consult with a tax professional.