Tax season may not be the most exciting time of year, but it can be less daunting when you know how to maximize your deductions. And if you itemize instead of taking the standard deduction, you can reduce any charitable contributions made in that tax year from your taxable income.

If you already make charitable contributions through Daffy, you're one step ahead, since all of your tax summary is stored for you in one simple place. But even if you need to sift through digital or paper receipts, we'll show you exactly how to claim charitable contributions on your tax return.

Where charitable contributions go on your tax return

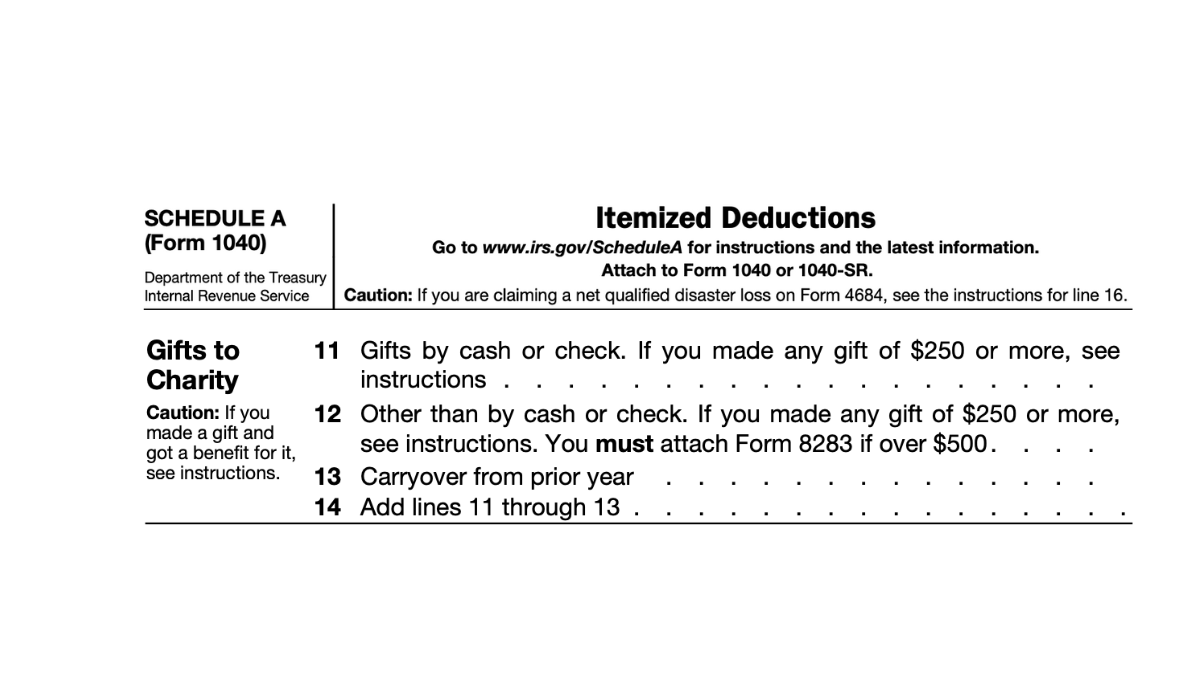

Charitable contributions are itemized on Schedule A on the IRS Form 1040. This form lists all of your itemized deductions. Remember, it only makes sense to itemize if all of your eligible deductions exceed the standard deduction.

Here are the standard deductions for the 2024 tax year based on your tax filing status:

- Single taxpayers and married filing separately: $14,600

- Married filing jointly: $29,200

- Heads of household: $21,900

Form 1040 lists out all the possible itemized deductions you could file, including eligible medical and dental expenses, state and local taxes (including real estate and property tax), and home mortgage interest and points.

Directly underneath the paid interest deduction is a section for gifts to charity. There are three lines that you'll add together:

- Line 11: Gifts by cash or check (you'll need to follow special instructions if gifts were over $250)

- Line 12: Gifts other than by cash or check (again, there are special instructions for gifts over $250 and you must submit Form 8283 for gifts over $500)

- Line 13: Carryover from the prior year

When your donation is over $250, you'll need a written acknowledgment from the charity. It's easy to fill in these numbers because we’ll give you a detailed record of your charitable contributions by year to simplify your tax return.

When to use Form 8283 for stocks and other noncash contributions (i.e. crypto, private stock, etc.)

Anytime you donate stock/ETFs, cryptocurrency, or other noncash charitable donations valued at $500 or more, you'll need to fill out Form 8283 as well. Some non-cash donations may require an appraisal, such as real estate, art, or a car. And if you donate private stock, you must:

- File Form 8283 Section B for a donation valued at more than $5,000,

- Obtain an independent appraisal from a qualified appraiser within 60 days (before or after) the date of the gift if the stock is valued at more than $5,000, and

- Attach the appraisal to your tax return if the shares are valued at more than $500,000.

You can skip the appraisal process entirely when you donate publicly traded stock. Fill out Section I of IRS Form 8283 with the contribution dates, your cost or adjusted basis, and fair market value.

How much you can claim on taxes for charitable donations

There are some limitations on deducting charitable contributions from your taxes. For most individuals, you can deduct donations up to 60% of your adjusted gross income (AGI). For contributions of non-cash assets held for more than one year (such as stocks or crypto), the limit is 30% of your AGI.

Here's an example of what the maximum limit looks like. Let's say your adjusted gross income is $240,000. The maximum amount you could donate and itemize as a tax deduction is $144,000.

The exception to this maximum deduction is if you're retired and must take a required minimum distribution (RMD) from an IRA. Any qualified charitable distribution (QCD) made from the IRA to the charity can count towards the RMD rather than being taxed. The annual maximum amount is $100,000 regardless of your total income. It's important to note that you cannot make QCDs to donor-advised funds (DAFs), including platforms like Daffy. There are many rules surrounding QCDs, so get the full details from your financial or tax advisor first.

Important Note: A total of 23 tax provisions that have encouraged charitable giving are set to expire at the end of 2025, including the increased 60% deduction limit. This makes the coming year a potentially advantageous time to maximize your charitable donations while these favorable rules are still in place. Consulting with a tax professional is recommended to ensure you're taking full advantage of the current tax environment.

How to deduct charitable donations without a receipt

It's possible to claim charitable donations as a deduction without a receipt, but there are some rules to follow. First, note that any cash donation under $250 does not require a receipt from the organization. However, you do need some type of bank statement or payroll deduction paperwork as a record for your tax files.

If you make any single donation of $250 or more, or donate any noncash asset, you will need to submit a receipt as a record of the contribution.

It's easy to simplify your record-keeping by donating through Daffy. As a donor-advised fund, Daffy is a tax-exempt charity recognized by the IRS. You contribute to your Daffy fund on your own schedule, which is recorded as a charitable contribution. Then you can send those funds anytime to the charities of your choice.

But from a tax record perspective, all of your tax-deductible contributions are made to Daffy. You get an annual tax summary in your member dashboard ahead of each tax season so you're ready with all the paperwork you need.

Frequently asked questions

1. Can non-itemizers deduct charitable contributions?

You can only deduct charitable contributions if you itemize your taxes. You can't claim a donation deduction on top of the standard deduction. If you aren’t sure when you should take the standard deduction vs. itemize, check out this helpful guide.

There was a temporary pause on this rule during the COVID-19 pandemic. For the 2021 tax year, taxpayers could deduct between $300 (for single filers) and $600 (for married taxpayers who file separately) of charitable contributions on top of their standard deduction. However, this rule is no longer in effect.

2. How much can I claim on my taxes for charitable contributions?

As long as you itemize your taxes, you can typically claim up to 60% of your adjusted gross income (AGI) for cash contributions. You can find your AGI on line 11 of IRS Form 1040.

3. What is a qualified charitable contribution?

A qualified charitable contribution (QCD) is a way for individuals who are 70 ½ or older to satisfy some or all of their IRA's required minimum distribution (RMD) without paying income tax. QCDs must be made from the IRA directly to the charity.

Note: The information provided is for educational purposes only and should not be considered investment advice or recommendations, does not constitute a solicitation to buy or sell securities, and should not be considered specific legal investment or tax advice. To assess your specific situation, please consult with a tax and/or investment professional.