Daffy was designed to be a community, bound together by a common commitment to regularly put money aside for those less fortunate than ourselves. However, under the hood of this new community is a brand-new, modern donor-advised fund, designed from the ground up for this purpose.

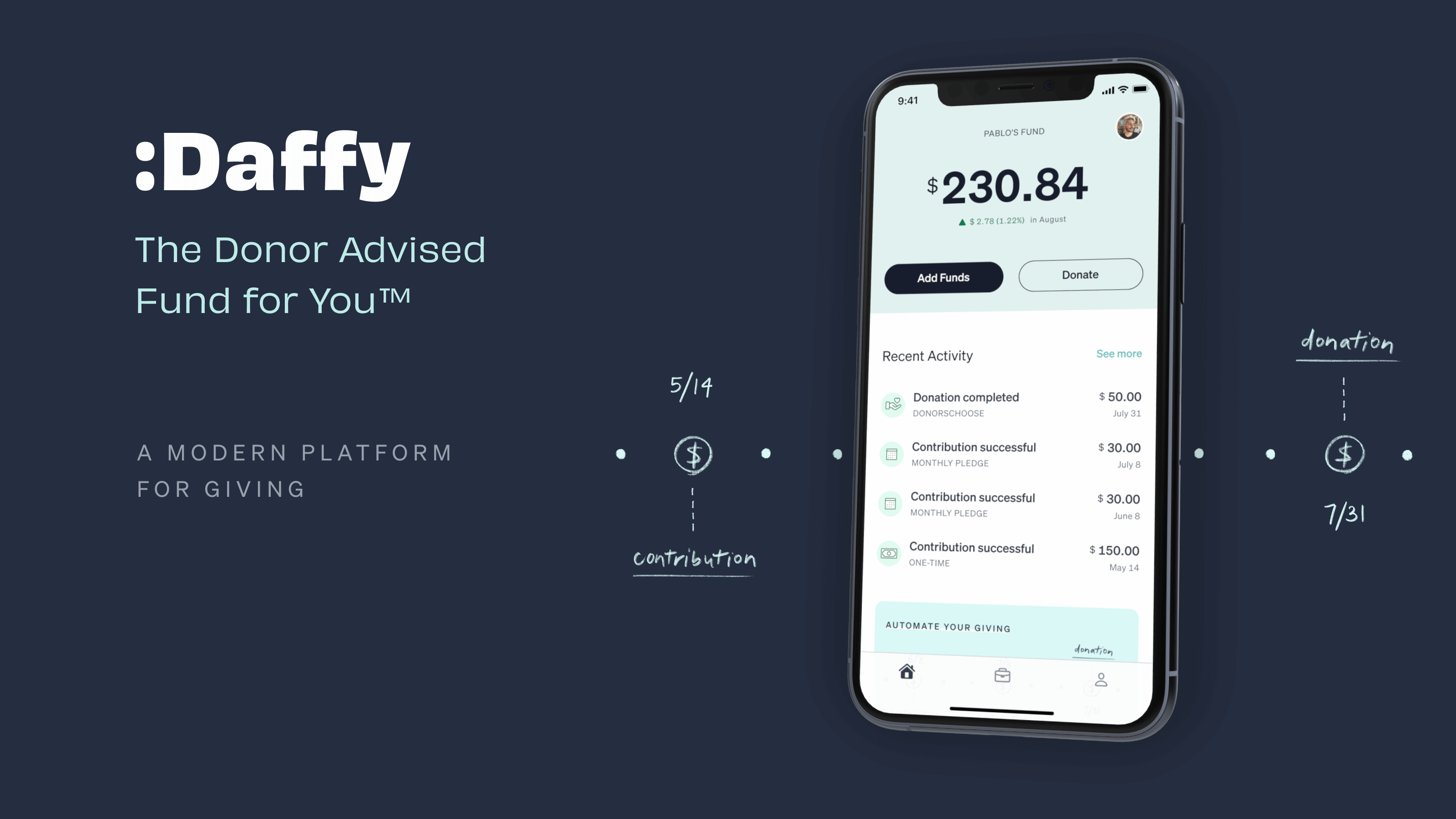

When people ask us why our organization is called, "Daffy," we cheerfully reply that Daffy is the Donor-Advised Fund for You™.

Of course, this answer almost inevitably begs follow-up questions: What is a donor-advised fund (DAF), and why haven't I heard of it before?

Like a 401k or an IRA for retirement, or a 529 plan for college, a DAF is just an industry term for a special type of financial account dedicated to charity. But unlike retirement plans and college plans, donor-advised funds to date have been almost exclusively marketed to the ultra-wealthy.

Donor-Advised Funds Today

Donor-advised funds have been around since the 1930s and were designed to encourage giving by allowing individuals to contribute assets into a tax-advantaged charitable account, invest those assets to increase potential impact, and have time to choose a specific charity for their donations.

So if DAFs have been around so long, why haven't they become as well known as 401ks or IRAs?

The answer might surprise you, but it's very simple. The largest donor-advised funds in the country (e.g. Fidelity Charitable, Schwab Charitable, Vanguard Charitable, etc) are supported by investment management companies. Their business model is simple — they charge a fee on top of the assets they manage.

These fees range from 0.5% to 1.0%, which means that a $500 account would only be worth between $2.50 to $5 per year. On the other hand, a $100,000 account would be worth between $500 - $1000 per year, closer to the revenue that these companies like to see from their average customer.

Not surprisingly given their business model, these firms have chosen to focus on large accounts of $100,000 or more. Many of them even have pricing and features that kick in at account sizes over $500,000, or even $5 million! Even mighty Vanguard Charitable has an account minimum of $25,000.

You have to be very wealthy to put aside large amounts like that for charity, and as a result, existing donor-advised funds are designed for wealthy clients who have the support of financial advisors or accountants.

So why haven't you heard about donor-advised funds? Most likely it is because the existing products weren't designed for you.

The Donor-Advised Fund for You

This is why we created Daffy, the Donor-Advised Fund for You™. We believe through Daffy, we can bring the donor-advised fund back to its originally intended goal, to help make it easier for people to give to charity.

Donor-advised funds are great financial products. They allow you to put money aside when it is convenient for you, with all the tax benefits of a charitable contribution. They ensure that your money is invested and can grow for additional impact. Most importantly, whenever you have the inclination to give, they make it simple to know how much you have available to give, and they provide an easy way to make that donation recommendation.

Donor-advised funds that charge a fee based on assets have an unfortunate conflict of interest. Every time you donate money to charity, they lose revenue. As a membership-based community, Daffy has no such conflict. Just a simple, transparent monthly rate. To help people get started, Daffy charges no management fee until members have reached $100 in their fund.

This is why our launch got so much attention. Industry experts are starting to notice that Daffy is remarkably less expensive than traditional providers.

That's not an accident. We designed it that way.

Make Giving a Habit

We know that most people want to give money to the charities and causes they care about, but professional and personal demands get in the way and people end up giving less than they would like.

Daffy changes this. By having a charitable fund and allocating money each week or month, you are proactively setting money aside for charity, so giving no longer gets pushed to the backburner—and your charitable contributions are invested to increase your charitable impact. Then whenever you want, you can make a donation to any of over 1.5 million charities in the U.S., with a just couple of clicks.

Sounds pretty good, right?

We're excited to make giving a habit—and hope you join us :D