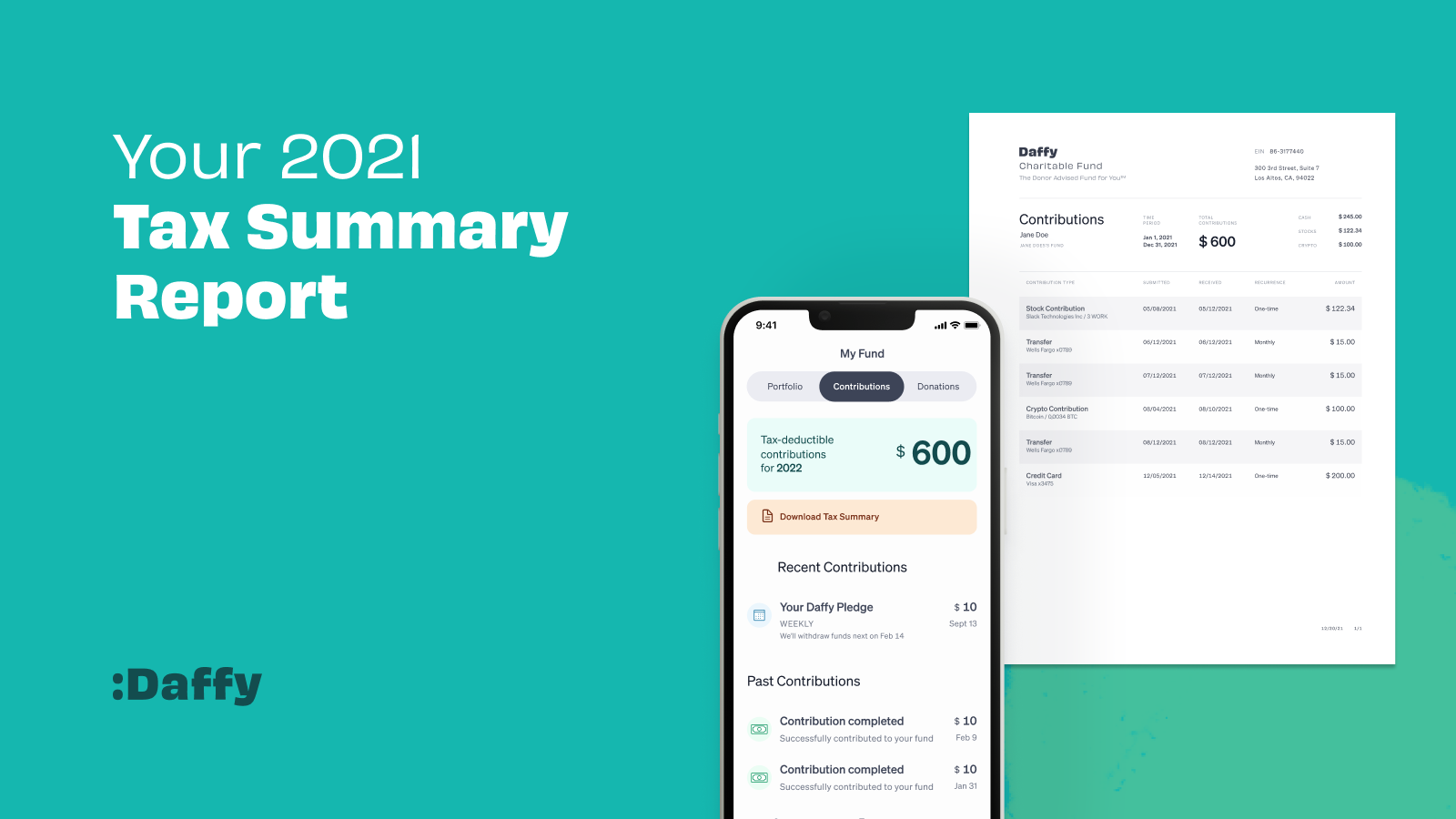

Earlier this week, we rolled out the ability for our members to view and download a simple summary of all of their contributions that may qualify as tax-deductible for 2021.

Everyone has a system for finding their charitable donation receipts. Whether it’s a special folder on your desk, a special tag in Gmail, or just the hail mary search of your inbox.

Since tax season often means tracking down a lot of receipts and documents, we wanted to help save our members the time and hassle.

If you’re a member of Daffy, you can view and download your Tax Summary report under the Contributions tab in your “My Fund” section in the Daffy app or by logging in on daffy.org.

If you’re not a Daffy member yet, but wish you had a simple report like this for next year’s taxes... good news, you can join Daffy, and we will even give you an extra $25 to give to a charity of your choice.

Plus, it doesn't come out just once a year. You can find it any time throughout the year in your Contributions tab.

And while we’re on the topic of taxes, below are a few reminders about charitable donations and contributions:

Contributions to a donor-advised fund: A big benefit of donor-advised funds like Daffy is that when you contribute to your fund, you're able to take an immediate tax deduction for those contributions. You also do not need to worry about capital gains taxes for any assets that you contributed and were sold. However, donations to charities from a donor-advised fund do not qualify for a tax deduction.

Stock contributions: If you contributed stock in 2021 that exceeded $500 in value, you will be required to file an 8283 Form with your federal income tax return. This is a standard form supported by almost all the tax-preparation software providers and is a simple addition for any certified tax professional.

Crypto contributions: If you contributed crypto in 2021 that exceeded $500 in value, you will be required to file an 8283 Form with your federal income tax return. Also, please note that if any single crypto contribution you made in 2021 has a value of more than $5,000, the IRS requires you to obtain a qualified appraisal.

April 18: Payment is due for Federal & State taxes.

Please note that the information contained in this email is for educational purposes only and should not be considered tax advice. To assess your specific tax situation, we always recommend that members consult with a certified tax professional.