Alejandro and I launched Daffy a little over two years ago with a simple mission: help people be more generous, more often. Daffy was founded with the belief that with technology and design we could close the trillion-dollar generosity gap just by helping people be the generous people they want to be.

But as a founder, you never really know. Sometimes you have to build it to find out.

2023 was a ground-breaking year for our platform and community of generous donors.

We finished 2022, our first full year of operations, with over $20 million in contributions from our members. In 2023, we were delighted to see that Daffy members made $9.8 million in donations to charities, an industry-leading 49% donation payout rate.

In 2023, contributions from Daffy members grew by 425% to over $105 million set aside for charity. Daffy now manages over $130 million in assets, backed by a community of more than 4,600 activated members.

A Better System for Giving

Our growth in 2023 exceeded our expectations, but it also validates two key hypotheses we had about the gaps and innovations needed in the philanthropic market.

First, donor-advised funds are a powerful tool to help people give and should be accessible to everyone. Similar to how a 401(k) can help people set money aside for retirement, a donor-advised fund (DAF) helps people set money aside for charity and donate to the charities of their choice whenever they’re inspired. Studies show that pre-commitment can increase the amount given to charity by 32%. If you set a savings goal and automate it, you’ll save more. It turns out the same is true for giving.

In 2023, we found that Daffy members with recurring contributions donate two times more than those that don’t.

Second, the business model of donor-advised funds needs to change. To date, the majority of the 60 million households that give to charity each year have never heard of a DAF or didn’t believe it was for them. Why? The traditional providers have marketed exclusively to the wealthy with high minimums and fees based on the assets they manage, typically starting at 0.60%.

The average American household is proud to put aside a few hundred dollars to give to the three to five charities that they regularly support. Where is the product for them?

Unfortunately, the business model gets in the way. When the incumbents charge a percentage of assets as their revenue model, it creates two chilling problems. The first is that they end up focusing on the largest accounts — the fees from a $10M account can be 1000x the fees from a $10,000 account. Second, they end up losing revenue every time a customer gives money to charity, a terrible incentive to warehouse assets.

Daffy is based on a fairly common business model among non-profit organizations: simple, flat monthly membership dues. Plus, to help people get started, Daffy charges no membership fee for accounts under $100. Whatever your level of giving, we want Daffy to be The Donor-Advised Fund for You™.

Growth Through Innovation

Since our launch, Daffy has released several innovative features to help people give:

- Daffy for Families. An industry-first, multi-generational giving feature that allows members to invite family to join them in their charitable giving. Many talk about the importance of generational giving and teaching your kids to give, but no other DAF provider offers a built-in feature. Once invited, family members can request donations, create their own profiles, and follow charities they care about.

- Daffy APIs. Almost every incumbent financial service provider offers the ability to easily donate. With Daffy APIs, any developer can design giving into their applications.

- Daffy for Advisors. Financial advisors help people with all of their financial goals, and that should include philanthropy. Daffy offers modern technology and low fees, as well as the tools for advisors to help manage and administer their clients’ donor-advised funds.

- Daffy for Work. Employers who prioritize talent, like OpenAI & Acorns, have realized they can easily encourage their employees to give back by providing a charitable giving account and offering a match or charitable gift.

- Daffy Campaigns. Donating, by itself, is a generous act. But now any Daffy member can create matching fundraisers for the charities and causes they care about, providing an even more leveraged way to use their giving to inspire others.

A Record Year of Donations

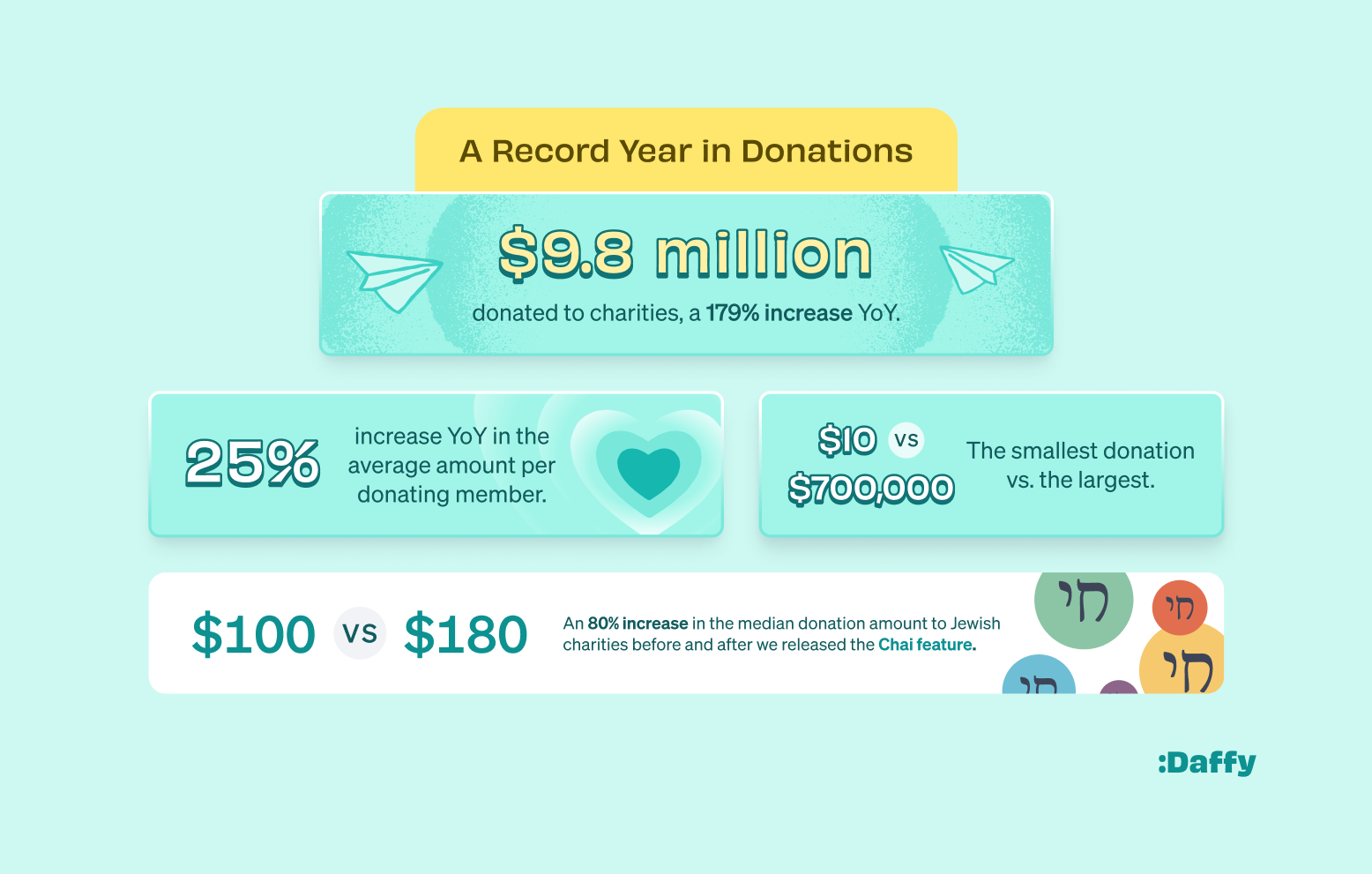

Most importantly, 2023 was a record-setting year for Daffy members in donations, with our members recommending over 9,000 donations totaling more than $9.8 million, a 179% increase over the prior year.

Most promising, we saw that the average amount per donating member increased by over 25% year over year, showcasing the power of Daffy to help people give. We also saw that over 36% of all donations were recurring donations.

Daffy’s donation payout rate was more than two times the 2022 DAF industry average.* The donation “payout rate” is a metric that the philanthropy industry considers to measure how quickly charitable assets are moving to charities through donation recommendations. In 2023, Daffy saw total donations of $9.8 million, a payout rate of 49% over the $20.0 million in contributions it received in 2022.

Fun Statistics About the Daffy Community

As Daffy's membership has grown, we have seen the platform scale to a wide variety of people across the country. What do they have in common? They all generously put money aside for charity. A few fun findings:

- Account sizes vary, a lot. Our smallest accounts at Daffy are only $10, our minimum contribution. Our largest accounts are over $10 million. 65% of members have a balance of $1,000 or less, while 2% of Daffy members have a balance of $250,000 or more.

- Daffy has gone nationwide. Daffy has members now in all 50 states and D.C., with concentrations in California, New York, Oregon, Texas, and Florida.

- Daffy is not just only for people in tech or financial services. Our growing community includes small business owners, healthcare professionals, lawyers, real estate agents, educators, nonprofit employees, pastors, rabbis, and airline pilots.

- Giving is not just for retirees. The average age of a donor in the U.S. is 65. However, on Daffy, we see a wide breadth of ages thanks to our Family features. Our youngest family member on the platform is 13, our average member is 41, and our oldest member is 76.

- Donating stock & crypto is not just for the wealthy. In 2023, our median stock contribution was $7,299. Our median crypto contribution was $1,004. However, some contributions were much larger. Our largest stock contribution to date was over $12 million, and our largest crypto contribution was over $5 million.

Check out the full infographic below to learn more about the amazing members of Daffy and how we’re creating a better system for giving.

We’re Just Getting Started

If you are a Daffy member, thank you. You have taken the first step towards being more generous by putting money aside for charity, and you have also helped seed a community and platform that we believe can positively impact millions.

2024 brings a new year and new opportunities to be more generous. Tell a friend about Daffy. Start a campaign for your children’s school or at your company. Set up a recurring donation. Increase your giving goal.

If you haven’t tried Daffy yet, make 2024 the year that you do and support the organizations and causes that mean the most to you and your family.

Of course, if you are a talented engineer, designer, or product manager, we’d love to hear from you. We are definitely hiring.

Come join us. 🙏

*The National Philanthropy Trust. ‘The DAF report.’ 2023. https://www.nptrust.org/reports/daf-report/. Both NPT and Daffy use the “Foundation Center” method which calculates the donation payout rate by this year’s grant amount divided by last year’s charitable contributions.

**All Daffy member demographics were provided through an opt-in member survey in 2023.