In this interview, Brad Saft, CEO and founder of DonorAdvisedFunds.com, and Adam Nash, co-founder & CEO of Daffy, dive deep into the realm of donor-advised funds (DAFs). This discussion encompasses everything from the benefits of using donor-advised funds to their transformative potential in the philanthropic industry.

Read on to discover why Brad and Adam believe everyone should have a DAF and where they believe the future of DAFs is heading.

Brad: So jumping right in, I've heard a lot of different perspectives on donor-advised funds. Could you share your definition of what is a donor-advised fund?

Adam: I think that all these terms sound mysterious in the beginning to most people. If you think about it, why would anyone know what a 401K is? It's a line in the tax code and yet over 40, 50 years, we've gradually educated everyone about what that is. It's a retirement account that has tax advantages. In the last 20 to 25 years, more people have been familiar with 529 plans because that's how you can save in a tax-advantaged way for college savings.

Usually, when I explain donor-advised funds to people, I start there. I explain that there's this type of account that exists, that's been around for decades, even if you haven't heard of it, it's a very simple account where you can put money aside for charity, get the charitable deduction, and it's just a tax-advantaged account for your charitable giving.

Just like you have an account for retirement, you may have an account for college savings for your kids. If charity is something that you do regularly, if you care about giving, you should have a tax-advantaged account for giving.

That's usually how I explain donor-advised funds to people.

Brad: The way that I often describe it is that I ask people if they own assets like stocks that can appreciate and do they give money to charity. If the answer is yes and they don't have a donor-advised fund then they absolutely should.

Because they are giving money away to the government that they could be giving to a charity that they care about if they're not taking advantage of it.

Adam: There's no question, there are phenomenal tax advantages to having a donor-advised fund. Even though the tax benefits are phenomenal, it's valuable without them.

Most Americans give a few hundred dollars a year to a handful of charities that they regularly support, maybe it's their church or their synagogue, maybe it's their kid's school, maybe it's their alma mater, maybe it's a national cause.

But we know from behavioral finance that budgeting is very difficult for people. Despite our best efforts, whether it's diets or budgets or that sort of thing, it's very hard to stick to these things.

Just having a separate place for your giving, so all your tax receipts are in one place, and you can set up recurring donations, just you have one place for your giving, is something that a lot of people see value in.

To your point about the question, if you're the type of person who gives to charity regularly, I tend to say, you should probably think about having a separate account for that and a donor-advised fund, I think, is the right account in the United States.

Brad: So when you have those conversations with people, as do I, it becomes pretty apparent that people should have donor-advised fund accounts. The way that these have spread largely in the past has been through conversations with accountants, financial advisors, and things like that.

But Daffy has taken things in another direction because you are attempting to educate the whole world on the benefits of DAFs without going through that traditional network.

How did you come up with that and how's it been working?

Adam: I think that before this modern era, I would say the last 10, 15 years of fintech, innovation, and software, that's the way that most people heard about financial products and services.

Some people were interested enough. We were that small group of people who found finance topics so interesting that in our spare time, we read up on these things.

But most people aren't like that. They're too busy with their lives. They have family, they have friends, they have work. My background is as an engineer and so I have this belief in technology, but what I've seen in my career is that software is very powerful.

Not just in helping people do things as tools, but in educating people on what they should be doing or what they could be doing. I've seen this even in fintech and finance.

I was on the board of a company called Acorns. Acorns now helps millions of people save better so that instead of being out of money at the end of the month, they have money put away and they can start their financial lives. I remember when Acorns rolled out retirement accounts, Roth IRAs. How many people know what a Roth IRA is, what IRA stands for, or whether they should have an individual retirement account? But there are now just hundreds of thousands of people, if not millions who have Roth IRAs through Acorns.

And the reason is they made it that simple. And they included it as part of the product journey. So when you downloaded this simple app to help you save money, they asked you, do you have a retirement account? And so a lot of that value that advisors, accountants, and other experts provide, I don't think it can be replaced per se in software in all cases, but I think that we can do a lot to reach millions of people who wouldn't have heard it otherwise by actually making it obvious and intuitive in the products that they use.

Brad: DAFs have grown in popularity substantially. Especially in the last five years. I'm interested in your initial point about the history of 401Ks. Was there some tipping point where there was a trickle of growth for 10 or 20 years, and then it just exploded?

Do you see DAFs going along that same trajectory?

Adam: There's a joke in Silicon Valley around startups and companies. Everyone always talks about overnight successes, but you find out the company's been around for 12 years and that team has been working for more than a decade to create this overnight success.

And I think that with financial products, there is a tipping point that happens when enough people know about the product, that if you just ask a friend or a colleague, odds are one of them is going to know something about it, right? So it's a little bit of a density thing.

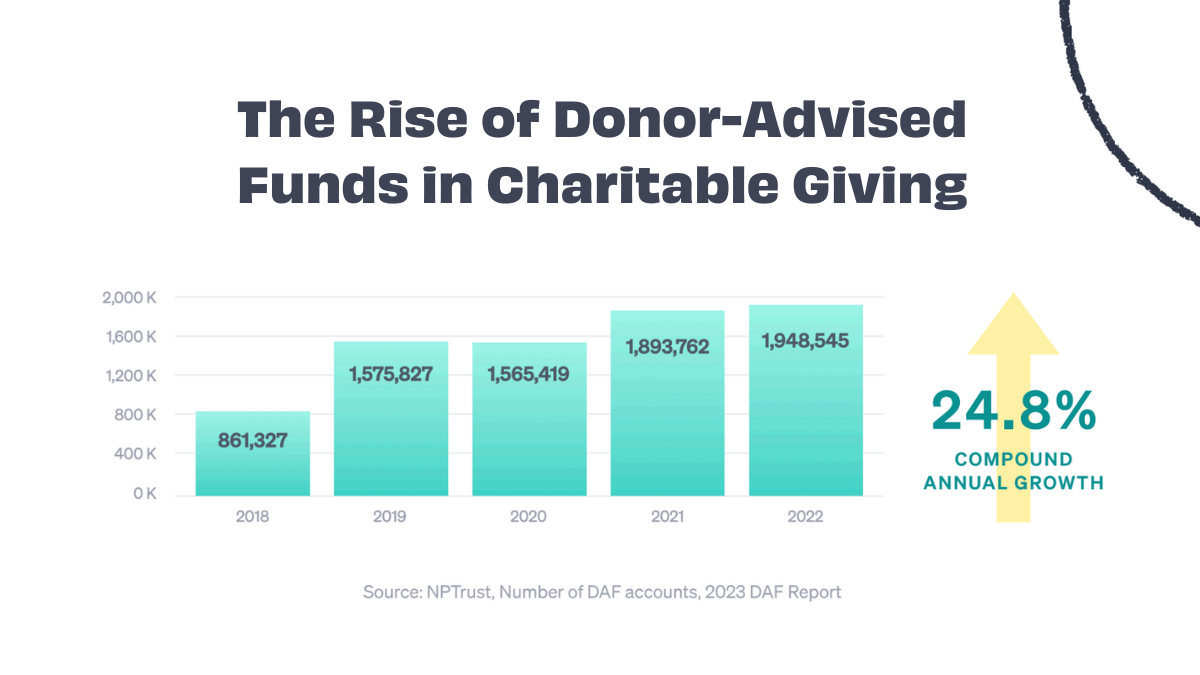

I mean, donor-advised funds have been around for more than 50 years, but it's been just in the last five years that donor-advised fund accounts went from having 1 million people who have them to 2 million. Just doubling that quickly.

So I think we're entering that portion of the S curve where you see this rapid adoption, but it just comes down to who's heard about it, who knows about it. And of course, money is a trust business. How many people do you have to know? How much exposure do you have to have to it before you trust your own money into a new account or a new financial product?

Brad: That's a great point. And one of the biggest surprises I found since learning about the market is that donor-advised funds are not a tool just for the ultra-wealthy. The average donor-advised fund size is $117-120,000. It is something that can be a part of a philanthropic strategy for a very wide range of individuals.

What have you seen in the people who have started opening their accounts with Daffy that has shown you that this is such a widely accessible market beyond what it's been in the past?

Adam: I've had a long career in technology. I'm an active angel investor.

The thing that is in common with successful companies is that they start with the basics. Who needs this? Who gets value from it?

With donor-advised funds, for so long, they've been targeted at wealthy clients. For people who had high-end financial advisors or accountants, the focus had been mostly on the tax benefits.

Money does scale. If you want to save large amounts on taxes, you end up with these very large accounts from these very wealthy individuals. But the truth is, there are a lot of different value propositions that people can get from donor-advised funds.

For me and my co-founder, we started with the basics of there being 60 million households in the U.S. that give to charity every year but there were only about a million donor-advised fund accounts. Wow, that's a real disparity. Maybe not everyone is going to get a donor-advised fund, but a million feels like a very small fraction of that audience.

So part of what we did was, we dove in and tried to understand why. Why do people not have donor-advised funds? What we realized is that the existing institutions, the Fidelity's, the Schwab's, the Vanguard's of the world, wanted more donor-advised fund accounts, but they wanted large accounts.

That's because their business model is based on charging a percentage of assets. Fidelity is the largest in the space, they have over 200,000 customers. But if you look at Fidelity up to $500,000.

Like who can afford to put aside half a million dollars for charity,. Regardless of how great the product is, up to half a million dollars? They charge 0.6% of the account, 60 basis points, which doesn't sound like a lot. That means that for every $100,000 account, they're making about $600 a year. 500,000 would be $3,000. And then we realized that there was a perverse incentive built in there, where Fidelity and the others lose money every time someone gives money to charity.

The more we looked at that problem and looked at the incentives, we said, oh, there is a real opening here. Maybe the reason that those 59 million households don't have donor-advised funds is because the product isn't designed for them.

The reason the product isn't designed for them is because the existing institutions have a business model where financially, it wouldn't make sense for them.

Brad: What made DAFs even come to your mind as saying, this is something I want to spend more time learning about.

Adam: The truth is, like all founder journeys, it came from multiple places.

And then there's this moment where it comes together. I learned about donor-advised funds the way most people used to learn about donor-advised funds, which is that I worked for a company. I was the VP of Product at LinkedIn, and LinkedIn went public in 2011.

And not surprisingly, it turns out, that when a technology company goes public, the campus becomes swarmed with accountants and financial advisors who are looking for customers who now have public stock. I ended up hiring an accountant, a great accountant, who told me about donor-advised funds.

He said, you know, this is going to generate a lot of taxes. Have you thought about giving some money to charity? And I said what I think a lot of folks in my situation said, which is I love to give to charity. I don't know if I can figure that out in just a couple of months, given how late we were in the year.

And he said, let me tell you about this magical account called the donor-advised fund. You put money aside in this account, you get the charitable deduction right away, and the money's invested tax-free. And anytime you want to give to a charity, you can.

And I said, well, how much do you put in this account?

And he said, well, there's no right answer, but one way you can think about it is, take what you want to give to charity every year, multiply it by 10, put it aside, you had a big year and then maybe you'll get years 11 and 12 for free, based on the investment gains. Then he told me that thing that you were talking about earlier, which is the fact that when you donate stock to a donor-advised funder to charity, you get a double tax benefit.

Not only do you get the charitable deduction, but you'll never pay the capital gains on that stock.

And I was surprised that more people hadn't heard of it. But that's where it was filed away. Even when I was CEO of Wealthfront, I had this list of great financial products that hadn't been reinvented yet, that were trapped with the ultra-wealthy, and there just wasn't general awareness of it.

And donor-advised funds were on that list, but couldn't figure out really what to do with it because the market just didn't look big enough to build a standalone product around. But that's when the epiphany hit.

I have four children and they all went to this wonderful school where one of the traditions that they had when they were young is that all the kids on Fridays would bring in spare change. They put in a little piggy bank and then every quarter they would vote as a class on which local charity to give the money to.

I was thinking what a wonderful tradition! Teaching the kids about giving, charity, and the community, but why do we teach children to put money aside every week, but as adults, we don't? And then it clicked for me. That's not true. Wealthy people who have donor-advised funds do that.

They put aside money proactively for charity. They have it set aside, invested for no other purpose. And then when they're inspired to give the money is there and available to them.

So when those two things came together I thought, wow, you could build a really important platform.

That's how Daffy was born and Daffy, of course, stands for the donor-advised fund for you.

So we're definitely focused on this market.

Brad: It’s interesting because my journey to starting donoradvisedfunds.com is pretty similar. I knew nothing at all about it. My advisor said hey, you should check this out. I said whoa, there's like a thousand different DAF sponsors that you could work with, so how am I supposed to pick one?

I attempted to research on the internet looking at the difference between, the big national ones, community foundations, religious foundations, and how to do it. And I realized that there was no resource out there that provided the philanthropically minded individual with all the different options.

When I recognized that didn't exist, I saw an immediate need that I wanted to fill to help people like myself understand that there are other options to find the perfect DAF sponsor that meets their giving and donating goals.

Since I opened my DAF, my method of giving has changed also. As opposed to just giving as the need came along, I think about it proactively every year I'm going to donate a certain amount and then that is already set aside for whatever I'm going to be giving to that particular year.

Adam: I think it's wonderful that you put together the site for donor-advised funds because I do think more and more people are asking about the account. But it's wonderful that you're educating people.

Educated consumers do more to shape the market. As more people learn about 401Ks, they learn more about what they should be asking companies for in their 401Ks.

The information is critical to actually helping shape that market. I'm not surprised actually that in your experience with donor-advised funds, like mine, you've noticed this basic fact that when you have a donor-advised fund, you end up giving more.

This is so obvious now. Richard Thaler won the Nobel prize in economics, around topics that relate to mental accounting and putting money aside. It turns out that one of the values of putting money aside for charity is that you've solved one of two big problems for giving.

The first problem is how much can I afford to give. And then the second is who do I give it to, And there's a lot of focus on that second problem. You want your gift to do good in the world, that's why you're giving the money, but very few people focus on that first problem.

But it turns out that, for most people, that's a very hard problem.

When we get asked to give, it's how much can I afford to give? And the donor-advised fund, no matter how big it is, we see the same behavior pattern in people is that whatever they can afford to put aside for charity, they put it aside.

And then when the inspiration comes to give. You don't have to solve that first problem. You have this app in your pocket where you can just give money to any charity or cause that you believe in.

Brad: One of the interesting things I think about Daffy is the focus on family and not just the individual donor.

What do you think about the role of families coming together and children's involvement? How is that going to impact giving going forward?

Adam: I think the traditional industry has known for some time, if you talk to a great financial advisor, wealth manager, most of their clients are older and they're thinking about legacy, they're thinking about their children, their grandchildren. And there's this big inspiration of giving being something that you pass down to the next generation, the generation after that, but we also see a lot of younger parents who want to find ways to involve their children.

One of the features that's been very popular at Daffy and that we're very proud of is our family plan. We made it very broad, you can add up to 24 people to your family plan.

And it's not because we think that there are so many people out there with that many children. I think that's a rare occurrence.

But what we heard from our members was that they wanted to invite their parents, they wanted to invite their siblings, they wanted to invite their children, grandchildren, spouses, all these different people. Because giving is fundamentally not something that you necessarily want to do alone.

Most financial tasks are not group activities. You have your spouse, and there's a household thing to it and money is fairly private for most people, but giving it is a little different. There's an element of pulling people together, the bonding that comes from other people who support this organization, who work at the organization, who support the causes you believe in.

And like I said, there's this educational component. And so I do think that family giving is going to be very big, not just for households, but more focused on that kind of intergenerational pass down of information education.

Brad: In the three-plus years since you started Daffy what's surprised you?

What's been different than what you thought going into it?

Adam: There are a couple of things, that have been surprising to me.

One was in the beginning. I thought there were going to be a lot of people who just wanted to give a small amount of money to charity every year and they just need a better product to do that. And then there'll be wealthier customers who want to do fancy things like contribute stock or mutual funds or even crypto and we even set up our membership that way.

But what's been surprising to me is that it is far more universal than I thought. We have received large contributions of stock and crypto measuring in millions of dollars, but the median contribution of stock is a few thousand dollars. The median contribution of crypto is even smaller. I think that one of the surprising things, when you build a product and a platform for the broad market, is that you discover those little cubby holes people like to put people into in the financial markets. They might be useful shorthand for people in the business, but it doesn't reflect the reality of how people work and how they operate.

When it comes to giving, I've been really surprised at how broad the market is. I think the other surprise I've seen is just how much excitement there was around things that I thought from the technology world were pretty obvious and yet haven't existed in other donor-advised funds.

One of our very popular features is that you can run a matching campaign for any charity or set of charities that you want.

It seems so obvious and yet, you don't see this level of innovation in the industry for the most part. And I think it's because we're coming at it from the technology standpoint of what can we build. What can we learn from these other successful products out there? Rather than coming from, this is just one of a hundred different types of accounts that Fidelity, Schwab, or Vanguard offers. We're focused on this problem.

Brad: When you look at the market today, let's say we're sitting here five years from now, what do you think that number is going to be in five years? And what do you think the trajectory is going to feel like over these five years?

Adam: I think we're at the knee of the curve. The growth in donor-advised funds has doubled in the last five years.

I think this is one of the fastest growing areas of all financial services right now and I think that awareness is going to come in the next five years. You're going to see a lot more involvement from the existing institutions to upgrade their products and services. I think very easily that 2 million donor-advised fund accounts in the next five years could more than double again.

I think for our platform you're going to start seeing more engagement from the nonprofit community of how they can reach these people better and interact with them. Always dangerous to make these predictions.

I think by the end of this decade, the donor-advised fund is just going to be one of those account types that people know about the way they know about an IRA or a 401K.

Brad: Over the past couple of years with the growth of donor-advised funds, they've come under some criticism, but I'd love to hear your take on what I think is a misconception that money that would have otherwise gone directly to charities is just staying in donor-advised funds and not going anywhere.

Can you share why that is not true?

Adam: I think there's a lot of fair criticism of donor-advised funds. But a lot of it stems from the behavior at the very highest tiers of wealth. The information I have is actually that donor-advised funds have payout rates and distribute money to charity much better than institutions that have been around for a very long time like foundations.

I do think that the donor-advised funds could do a lot more to encourage people to give. And I think one of the problems is by focusing on the wealthy, they are focusing on people who, for tax reasons, might put a lot of money aside upfront and then spend it down over time.

Whereas most Americans tend to put money aside and give it in the same year. If you look at Daffy, what we're seeing in our member base, we just published our results, but we're seeing a phenomenally high donation rate. The reason we're seeing it is because most of our members are those types of people who have a small set of charities they support every year.

They know how much that is, and we help them put aside a small amount of money every week or every month so that need is funded. And so I think that as donor-advised funds move in that direction and they broaden out, some of that criticism will turn out to be just an artifact of how the industry started.

Brad: Yeah, what's fascinating about it is there is still, I believe, five times as much money in private foundations as in donor-advised funds, and yet the payout rate of those private foundations is much lower than donor-advised funds. You are seeing donor-advised funds putting that money to work in a way that private foundations are not.

As you look forward to so what's gonna happen just in the next year, what are your immediate predictions for 2024 for DAFs?

Adam: I think that for 2024 in the short term, we're going to continue to see growth in the category, continue to see growth and awareness.

I think your traffic will go up, as more and more people want to learn about this.

I'm hoping Daffy has a role to play too, in terms of innovation.

I feel very proud that the last two years we've been able to be a bit of a provocateur, a little bit of the technologist saying, why not? Why can't we have family plans? Why can't we have APIs to integrate this? Why can't this be a workplace product? Why can't we have campaigns?

For us, we'll be doing a lot more innovation throughout the year, but I think in general what I'm seeing from nonprofits is more and more people finding value in donor-advised funds. What's the best way to reach them?

So I'm expecting to see a lot in 2024.

I would say innovative and forward-thinking nonprofit organization's outreach and integration with donor-advised fund platforms to figure out how to make it easier for those donor-advised funds to support the organization.

I think the reason that's going to happen is because it turns out donor-advised funds provide something valuable to those nonprofit organizations, which is the ability to provide consistent support year over year. Most nonprofits struggle to raise money every year. Not every year is a good year and the fact that donor-advised funds are relatively stable sources of funding, that those donors are the type of people who put money aside for charity, I think in 2024, you're going to see at least a few big nonprofit organizations push into this idea of going after the type of people who have donor-advised funds as a specific way of raising money for their organization.

If you want to take the next steps of opening a donor-advised fund, visit daffy.org/adamnash/invite to kickstart your journey with an additional $25 to support the causes close to your heart.

Similarly, visit donoradvisedfunds.com for additional resources or further explorations and guidance.

“I think you'll find what I did when I opened my first donor-advised fund more than a decade ago, is that when you put money aside for charity, you end up being more generous and there's this weight off your shoulders every time someone asks you for a donation or to give, or you're inspired to give of knowing that you actually have the money to do it,” Adam Nash.