2024 has been a big year for stock and crypto investors.

With the S&P 500 up 20.10% year-to-date, Nasdaq-100 up 21.51%, and Bitcoin delivering returns of 66% (as of 11/01/2024), many investors are sitting on investments that have appreciated significantly.

Of course, all that success brings some challenges. It might seem prudent to take some of that money off the table. But if you sell some of those investments to realize some of those gains, it could mean a significant tax bill. What if we told you that there was a way to realize some of those gains, lower your taxes, and make a real difference for the charities and causes you support?

At Daffy, our mission is to help people be more generous, more often. For 2024, we are going big with our most ambitious campaign ever.

Your portfolio has grown. Your impact can too.

It’s time to put those gains to good use.

Introducing the $10 Million Gains for Good Challenge

Our goal this year is simple. Collectively, can we put aside at least $10 million this holiday season for charity by donating stock and crypto? It’s a big goal, but in a year of big gains, we think it’s possible.

Starting today through Tuesday, December 17, we're encouraging you to turn your market gains into ‘Gains for Good’ by donating appreciated stock, mutual funds, ETFs, or crypto, to avoid capital gains taxes and help us raise $10 million for charity.

And to help motivate our generous community, we’re going to make it even more rewarding to donate stock and crypto. Yes, that’s right. We’re giving away prizes.

🎁 Daily Prize: $100 Daffy Gifts: Win a digital gift card for a charity of your choice.

💰 Grand Prize: $5,000 for charity: We'll drop the money in your Daffy fund, so you can distribute it to your favorite charities.

👕 A limited edition Daffy T-Shirt: If we hit our $10 million goal, everyone who participates receives this thank-you gift.

The Triple Win of Donating Appreciated Assets

But the true reward goes far beyond these prizes. When you donate appreciated assets held for more than a year instead of cash through a donor-advised fund, you create a triple win:

1. 🏦 Avoid Capital Gains Taxes & Save More On Your Tax Bill

When you sell an appreciated asset, you are subject to capital gains taxes. These taxes can be quite large—over 37% between federal and state taxes in California. But not when you donate. When you donate investments that you have held for more than one year, like stock, ETFs, mutual funds, or crypto, you get to deduct the full fair market value and you never have to pay the capital gains taxes. 🤯

As you can imagine, that can add up to quite a lot as Daffy member Al points out:

"I probably would have saved 30 or 40 grand if I knew about DAFs back in the day. If you open a donor-advised fund and contribute appreciated stocks, you can really avoid a lot of taxation.”

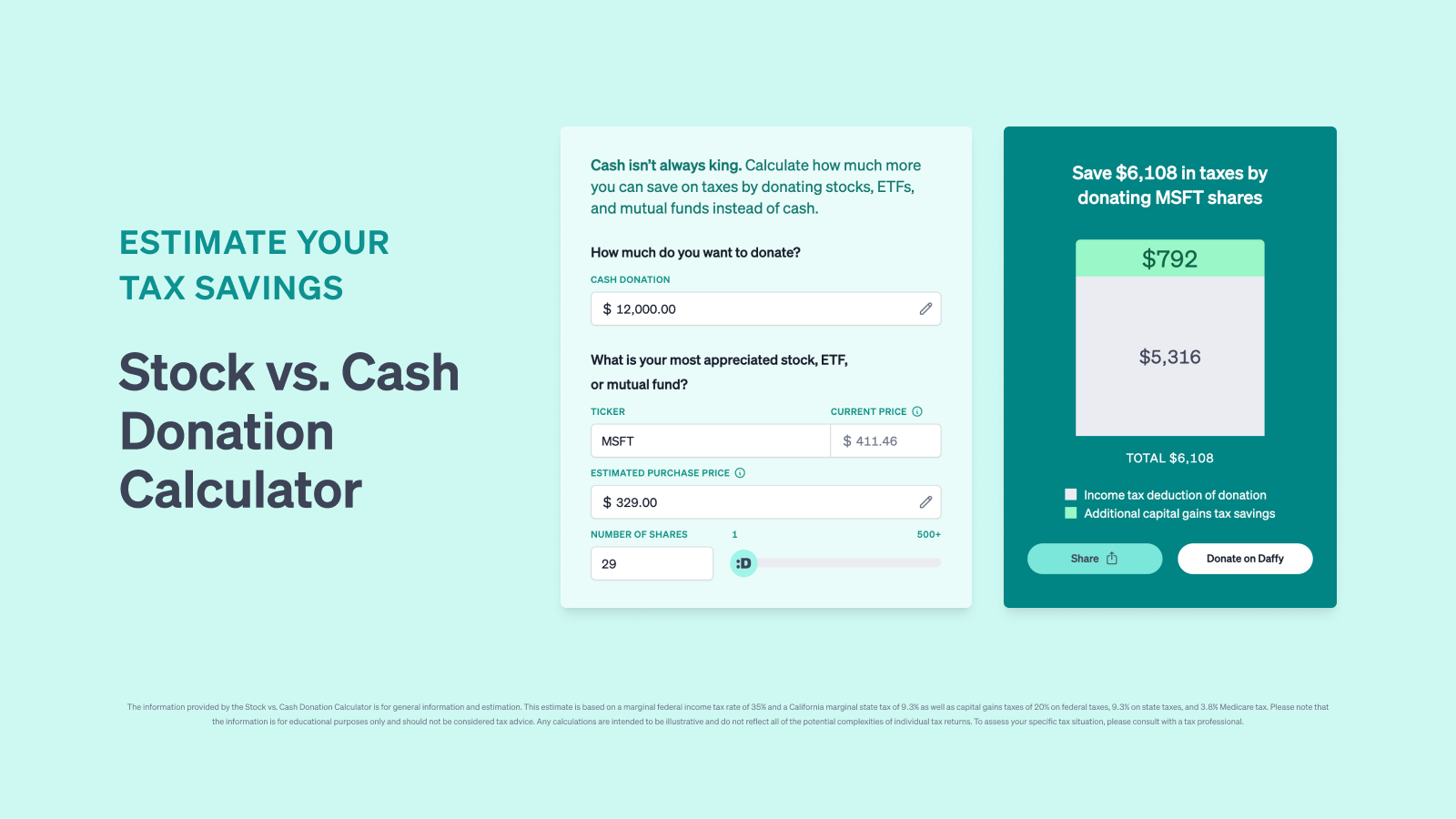

Want to know how much you could save (and give) by donating your appreciated assets? Use our free calculators to explore your potential tax savings:

- For stocks, ETFs, and mutual funds: daffy.org/stock-donations-calculator

- For cryptocurrency: daffy.org/crypto-donation-calculator

2. 📈 Grow Your Impact Tax-Free

When you contribute assets through a donor-advised fund like Daffy, you get an immediate tax deduction, and your funds have the potential to grow tax-free in your chosen investment portfolio. That means more money for the charities you support over time.

Daffy member, Pranav Garg, shares his experience with how the tax-free growth of his Daffy fund has grown his charitable impact:

"I started investing my charitable dollars in 2022 when the market was very low. And even after giving $22,000 out to charity, over two years, I still have $17,000 left, even though I invested $32,000. The money is growing even as I give."

3. 💖 Use Investment Gains to Support Multiple Causes

Since charities aren't subject to paying capital gains taxes, they receive the full value of the donated asset. There's just one catch: most charities aren't set up to accept stock or crypto directly.

That's where donor-advised funds like Daffy come in.

We make it easy by handling the liquidation of your assets. Once your assets are in the fund, you can grow your charitable dollars in the portfolio of your choice. Then whenever you're ready, you can distribute money to any number of U.S. 501(c)(3) charities, schools, or religious institutions. For example, you could donate appreciated VTSAX valued at $4,934 today, invest that money tax-free, and then support multiple charities over time with those funds, from your local food bank to national disaster relief efforts.

How to Participate in #GainsforGood

Joining the Gains for Good Challenge is simple, and every donation gives you a daily chance to win prizes for charity.

- 💸 1 Entry: For each unique stock, ETF, or mutual fund donation per day

- 💸 1 Entry: For each unique crypto donation per day

And guess what? Every day is a chance to win. So the more days you give, the more chances you have to win money for the charities you love. Winners will be announced daily on X @DaffyGiving and notified via email.

More information and the Official Rules.

To get those competitive juices flowing, we have put together a fun site to track our progress. At daffy.org/gainsforgood, you'll be able to track our progress towards our $10 million goal and discover real-time insights into our community's charitable giving, such as:

- Which crypto assets are most donated by members?

- Who is more generous—Apple or Google investors?

- Which ETF is being donated most often often?

…and more!

Don't Wait, Turn Your Gains into Good Today!

So what are you waiting for? If you want to, save significantly on your tax bill, maximize your impact, and get daily chances to win additional funds for your favorite causes, join us in the Gains for Good challenge at daffy.org/gainsforgood by December 17 at 11:59 PM PST.

And remember, the 2024 tax year is coming to a close. All of these contributions can qualify you for an immediate tax deduction in this calendar year.

You can follow @DaffyGiving on X to track daily winners and our progress toward our $10 million goal.

Join the challenge today at daffy.org/gainsforgood.