When we launched Daffy, the Donor-Advised Fund for You™, less than three years ago, it was the first fully functional donor-advised fund in the App Store. We launched with a very simple concept: Save. Invest. Give.

It was a simple idea: put some money aside for charity, invest it, tax-free, to grow your impact, and then give it to organizations and causes you believe in.

Some of the best ideas are the simplest.

Since then, we have been blown away by the response. Last year, Daffy members set aside over $105 million for charity. Donations were up over 120%. But one of the most startling numbers that we have seen is the investment growth in our accounts. Daffy members have seen their accounts grow by over $30 million — that’s an incredible amount of money raised, all for charity.

So when we asked ourselves what could we do to help encourage more members to put more money aside for charity, we looked to our members for insight. One of the most common requests has been for more options for investing their contributions.

Until today, Daffy has offered members an industry-leading set of portfolio options — 15 different portfolios including Conservative, Standard, ESG, and Crypto.

As the co-founder and CEO, I’m both proud and slightly embarrassed to say that the team may have overshot the mark on this one.

But as of today, we are providing our members with even more ways to grow their giving.

Over 100 quintillion more. 🤯

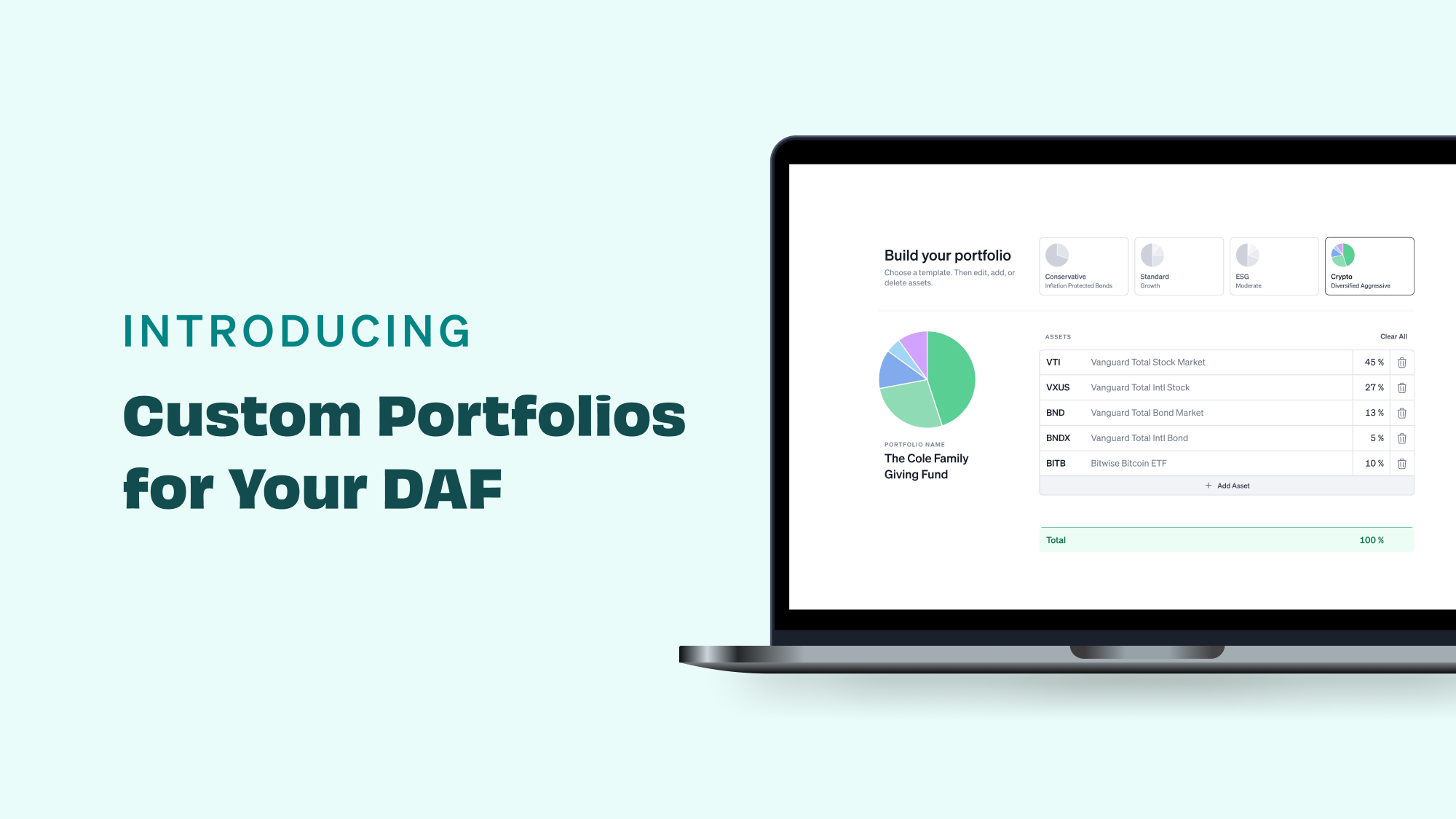

Introducing Custom Portfolios

Selecting the appropriate investments for a charitable fund like Daffy is not trivial, and our team put significant effort into ensuring that Daffy Charitable Fund invests in only the highest quality providers and products. Daffy now supports low-cost, high-volume ETFs from top-quality providers like Vanguard, Blackrock iShares, Fidelity, Schwab, State Street, Van Eck, Bitwise, and State Street SPDR.

In total, Daffy now supports over 460 ETFs on the platform. Daffy members can propose a portfolio of up to 10 ETFs, generating over 100 quintillion possible ways to tailor your fund to your specific giving plan.

Customizing a portfolio has never been simpler. Daffy built its own tool, from scratch, to make it simple for our members to start with our pre-approved portfolios and then modify the investments and percentages down to 1% increments. Each fund has been color-coded across over 20 different asset classes, to help our members better understand the risk/reward trade-offs they are making as they tailor their portfolio recommendation.

Match Your Portfolio to Your Giving Goals

It may not come as much of a surprise, but Daffy members vary significantly in how they approach their giving.

Some members contribute to their fund on a weekly or monthly basis, putting aside money for charity at a rate that matches their annual giving. Other members contribute opportunistically, taking advantage of “good years” to over-fund their accounts to help give more in years where they make less. Some members want to fund long-term commitments, with a portfolio that can generate funds every year to support the organizations they care about.

With custom portfolios, Daffy is now opening up our platform to allow our members to propose more tailored portfolios that match their giving intentions.

To help illustrate this idea, we asked a couple of Daffy members to share how they plan to use this new feature. Here’s what they’ve decided:

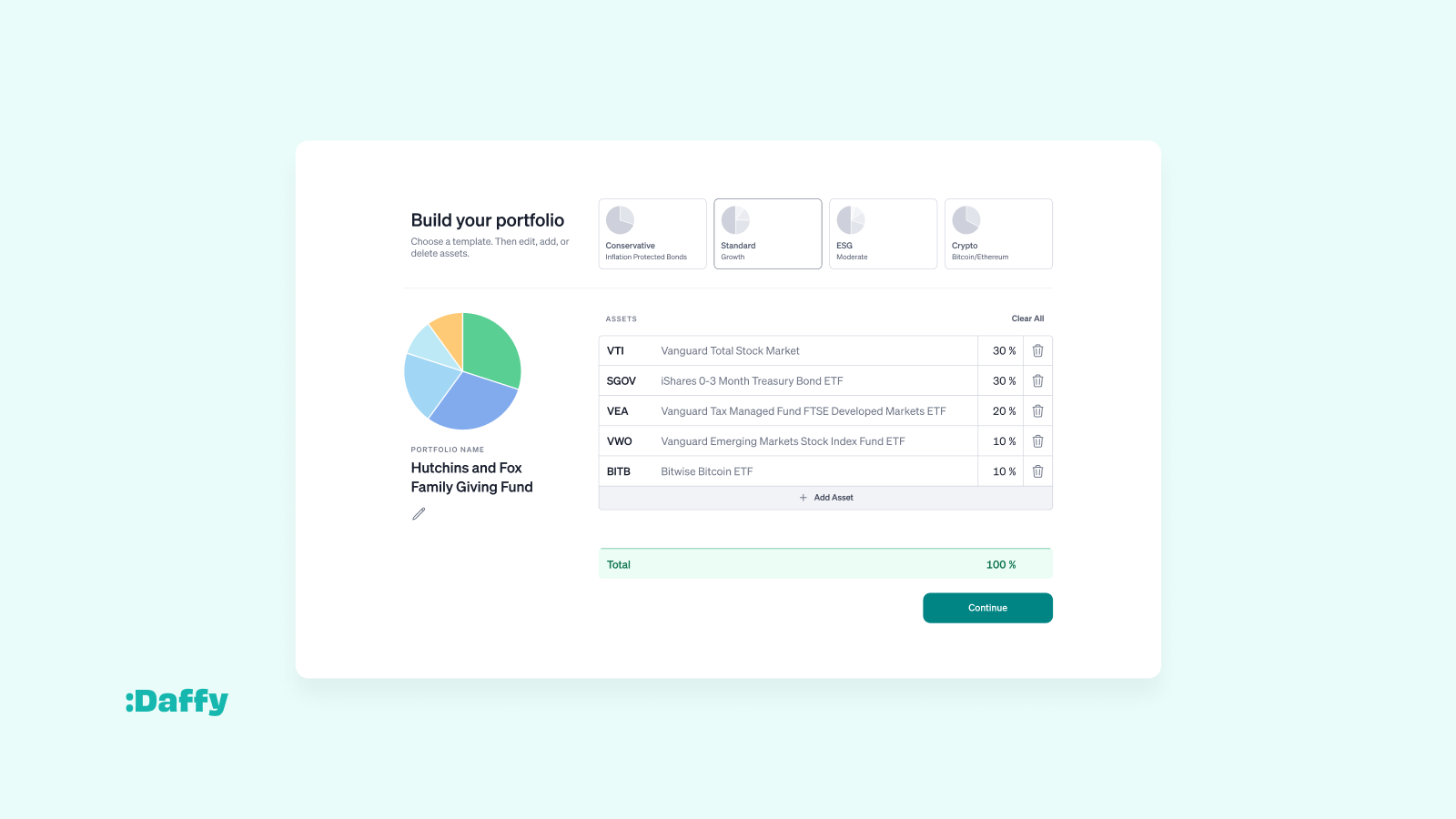

Chris Hutchins, host of “All The Hacks,” had previously been using the “Standard Growth” portfolio at Daffy, a globally diversified portfolio of low-cost Vanguard funds across stocks and bonds. Chris wants to invest funds for the longer term in riskier assets, like Bitcoin, to boost the risk-adjusted return of the portfolio. However, since he gives actively every year, it also makes sense to have a portion of his portfolio in cash and short-term bonds.

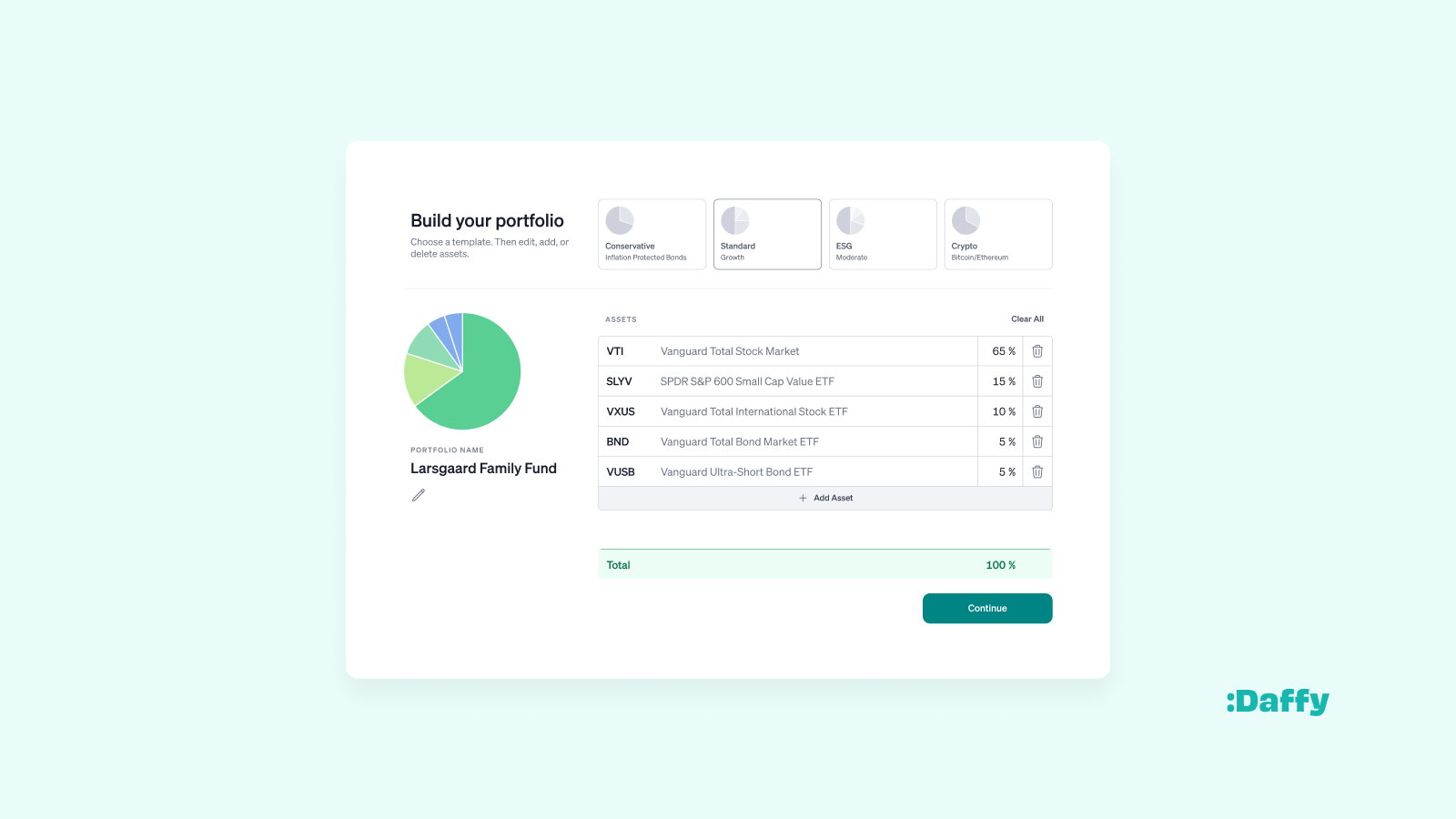

Joel Larsgaard, co-host of “How to Money,” was looking to balance his short-term giving goals with the long-term growth of his charitable funds. He used Daffy’s custom portfolios to allocate a portion of his investment portfolio to cash & bonds as a more conservative investments while placing the majority in a globally diversified mix of low-cost stock funds.

Save, Invest, and Give More with Daffy

Daffy was founded with a mission to help people be more generous, more often. Americans gave over $557 billion to charity in 2023, but we believe this number could be even higher. In fact, we believe it could be over a trillion dollars larger over the next decade. However, it won’t happen by itself. This industry needs to invest in new technology, new features, and a new business model if it is going to support the generosity of the 60 million households who give to charity every year.

With the addition of custom portfolios, we believe that we will unlock even more giving. Whether you manage your donor-advised fund directly or with the help of a financial advisor, we’re excited to see our members better align their funds with their giving goals.

If you are a Daffy Benefactor, this feature is already live and available on both the web and natively in our iOS app. If you aren’t, well, isn’t today the right time to open an account or transfer one from a legacy provider?

Come join us. 🙏