On March 28, 2024, we released two new Crypto Diversified portfolios that leverage Bitwise funds to add crypto exposure to traditional, low-cost globally diversified portfolios of stocks and bonds. Daffy has a strong track record of innovation around charitable giving, and we are proud to be the first major donor-advised fund to add direct support for the new Bitcoin ETFs.

As a follow-up to the announcement, we thought it would be helpful to dive a little deeper and share answers to some of the most common questions we’ve received about these new portfolios.

Why Offer Crypto Portfolios?

At Daffy, our mission is to help people be more generous, more often, and we want to meet the needs of a variety of donors, so we aim to offer a diverse set of portfolios ranging from conservative portfolios of cash or bonds, low-cost index funds, ESG-rated investment portfolios, or modern crypto portfolios. This allows our members to find the right portfolio based on their philanthropic goals and timeline.

We believe that offering diversified portfolios that include crypto as an asset class will both encourage more people to put money aside for charity and better help them grow their giving potential over time.

Daffy was the first donor-advised fund to launch with crypto portfolios as a standard option for members, including pure crypto portfolios invested directly in Bitcoin and Ethereum.

These portfolios have seen significant gains in the past year, allowing Daffy members to give more to the causes and charities they support. In fact, in the aggregate, Daffy Charitable Fund has seen over $20 million in gains on our platform in the 2+ years since our launch.

Why Launch New Crypto Diversified Portfolios?

More and more financial advisors and professional investors are looking at crypto as a useful and valuable addition to a diversified investment portfolio, and not surprisingly, there have been more and more requests from Daffy members related to crypto. In particular, we have seen requests for more aggressive diversified portfolios that include Bitcoin.

With the release of the new Bitcoin ETFs in 2024, we saw a unique opportunity to offer low-cost, globally diversified portfolios across traditional asset classes like stocks and bonds and new asset classes like crypto.

For members who prefer native crypto portfolios, Daffy continues to offer portfolios of Bitcoin, Ethereum, and a combination of the two based on our partnership with Coinbase.

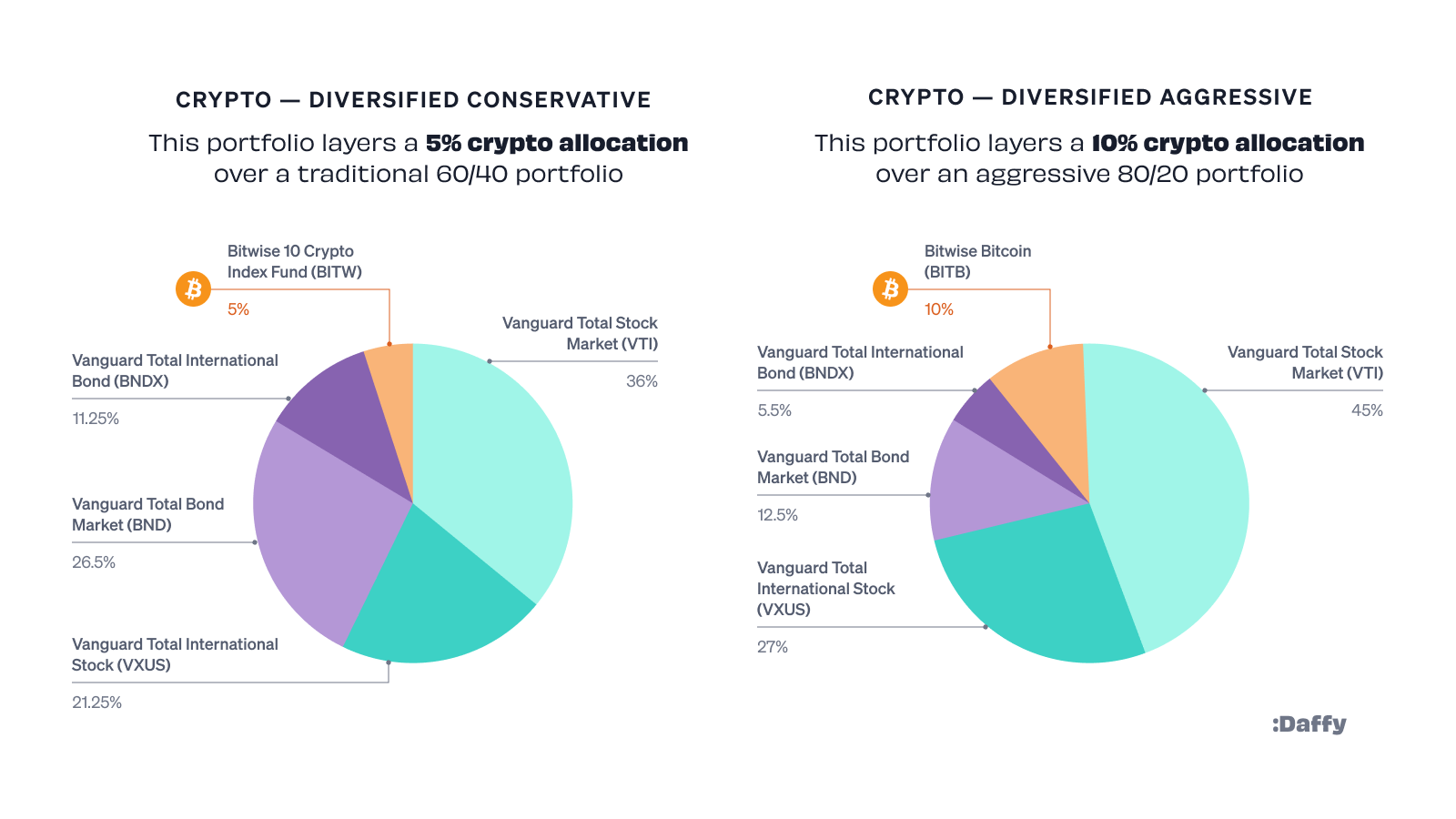

For members who prefer a low-cost, globally diversified portfolio of assets that includes crypto, we now have two excellent options:

- Crypto - Diversified Aggressive: Designed for those seeking even more crypto exposure, this portfolio follows an 80/20 split of stocks and bonds, with a 10% allocation to crypto through the new Bitwise Bitcoin ETF ($BITB), rebalanced daily. This portfolio has a low, allocation-weighted expense ratio of only 0.06%.

| Percent | Asset Class | ETF (ticker) | Expense Ratio | |

|---|---|---|---|---|

| 45% | US Equities | Vanguard | VTI | 0.03% |

| 27% | International Equities | Vanguard | VXUS | 0.08% |

| 12.50% | US Bonds | Vanguard | BND | 0.03% |

| 5.50% | International Bonds | Vanguard | BNDX | 0.07% |

| 10% | Bitcoin | Bitwise | BITB | 0.20% |

| 100% | Total | 0.06% |

- Crypto - Diversified Conservative: This portfolio maintains a globally diversified approach based on the traditional 60/40 split of stocks and bonds, but with an additional 5% allocation to crypto via Bitwise 10 Crypto Index ($BITW), rebalanced daily. This portfolio has a low, allocation-weighted expense ratio of only 0.17%.

| Percent | Asset Class | Provider | ETF (ticker) | Expense Ratio |

|---|---|---|---|---|

| 36% | US Equities | Vanguard | VTI | 0.03% |

| 21.25% | International Equities | Vanguard | VXUS | 0.08% |

| 26.5% | US Bonds | Vanguard | BND | 0.03% |

| 11.25% | International Bonds | Vanguard | BNDX | 0.07% |

| 5% | Crypto | Bitwise | BITW | 2.5% |

| 100% | Total | 0.17% |

What’s the Historical Performance & Risk Involved with Crypto Portfolios?

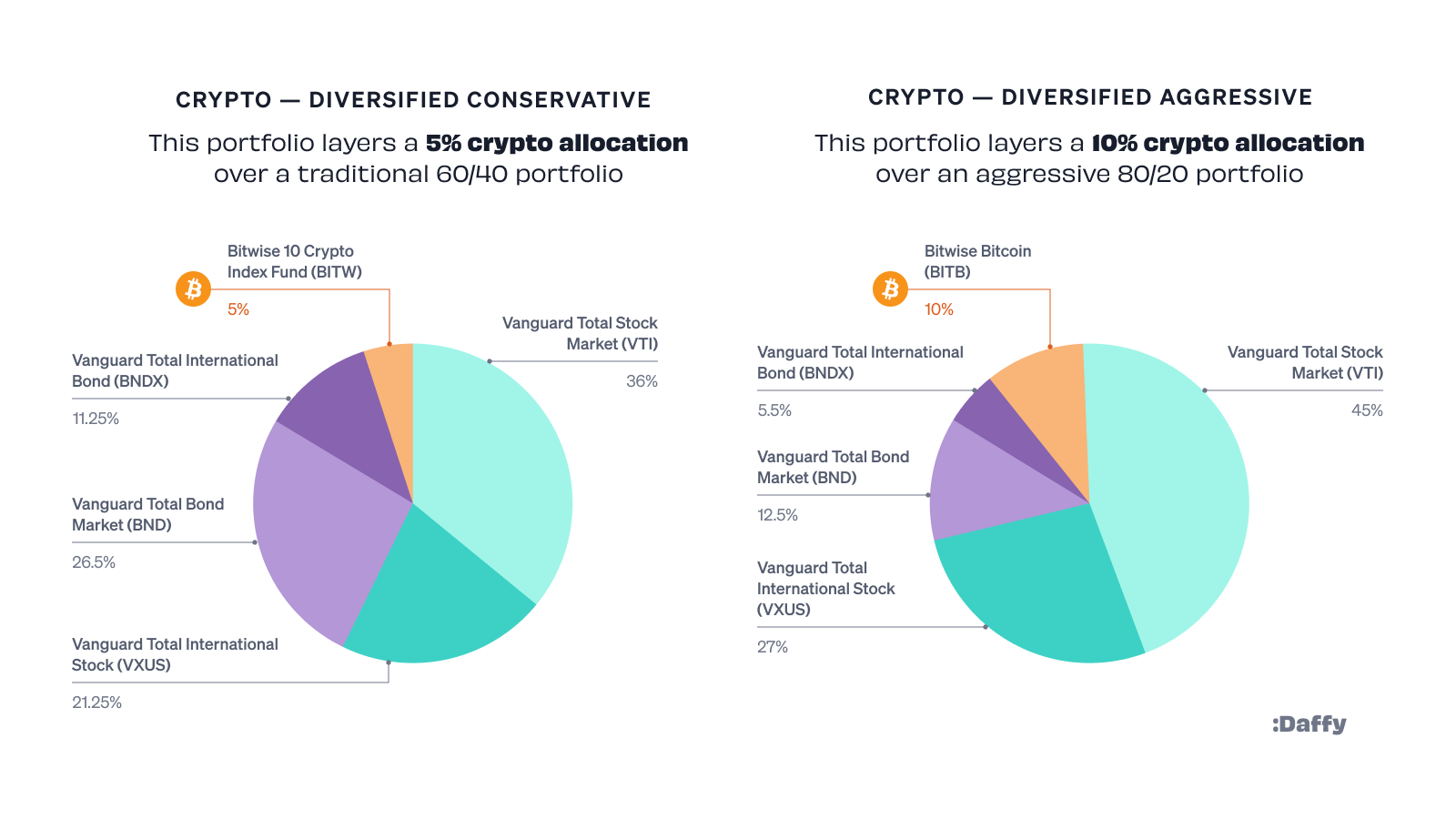

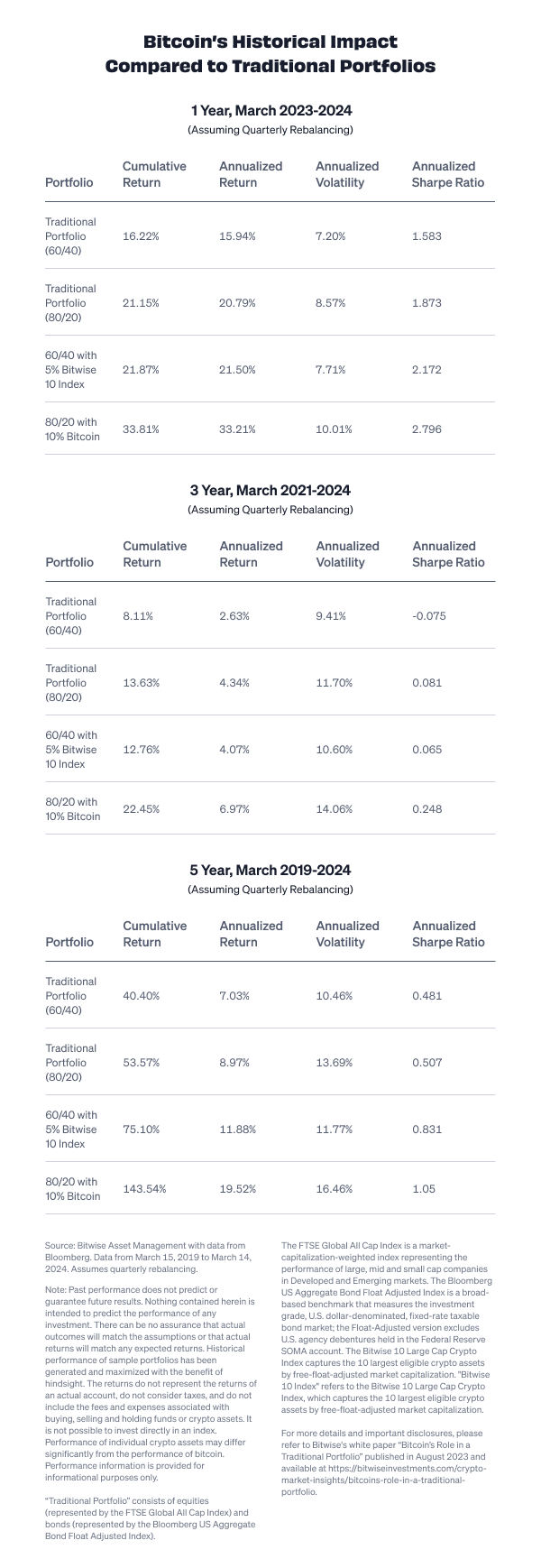

Many investors focus on the high volatility of crypto assets, like Bitcoin, while ignoring the benefits they may add when combined with traditional assets in a properly rebalanced, diversified portfolio. Fortunately, research published by Bitwise Investments indicates that over 1-year, 3-year, and 5-year periods, adding Bitcoin to a traditional diversified portfolio of stocks and bonds greatly improves the risk-adjusted return of the portfolio.

In other words, adding a relatively small allocation to crypto does increase the portfolio's volatility, but the increased returns justify that increase in risk.

At our request, our partners at Bitwise Asset Management ran some formal analysis of the benefits of our approach to adding crypto to traditional diversified portfolios, and think it is worth sharing.

Please note that this analysis not only includes the return of these portfolios over these time periods, but also the volatility and the Sharpe ratio. These are common measures used by academics and professionals to compare the risk-adjust returns of different portfolios.

*All expense ratios are as of 3/15/2024. Expense ratios are portfolio-weighted and calculated using publicly disclosed expense ratios for each fund. Daffy portfolios are managed as fully invested in the securities outlined above. However, from time to time portfolios may have a small temporary cash balance for liquidity purposes when managing the inflow of contributions and outflow of donations.