Unlock the Potential of Your Private Stock

As companies stay private longer and more wealth remains tied up in equity, Daffy’s innovative Private Stock Donation Program allows employees to donate private shares, reduce taxes, and make a bigger charitable impact.

With more private companies doing tender offers to provide liquidity to their teams, every company offering a tender should run a private stock donation program. Companies can help improve employees’ financial outcomes while unlocking billions for charity.

— Adam Nash, Co-Founder & CEO of Daffy

Benefits For Employees

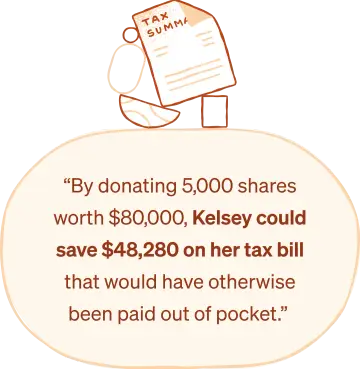

- Qualify for an immediate income tax deduction at the current fair market value of shares held for more than one year.

- Avoid capital gains taxes. Donating long-term appreciated private stock exempts you from paying taxes on the gains.

- Give more. Charities get the full value of your liquidated stock without paying capital gains taxes.

- Access to Daffy for free while an employee of the company.

*This estimate is based a household income of $500,000 with a marginal federal income tax rate of 35% and a California marginal state tax of 9.3% and capital gains taxes of 18.8% on federal and NIIT taxes and 13.3% on California state taxes. The purchase price of the stock was $8 and the current value is $16.

High Value for Your Company

- Recruiting & Retention. All employees have access to Daffy for Work for free.

- Supports Company Values & Culture. It’s one thing to tell your employees you value generosity and giving, but it’s another to enable it with a program.

- Increases Brand Reputation. “Employees set aside $50M for charity this year.”

- Supports both Private & Public Companies. Daffy for Work supports private and public stock, so it can seamlessly power programs post-IPO.

Add Your Company

Join industry leaders like Figma in empowering employees to donate private stock, unlock tax benefits, and make a greater charitable impact. If 20 or more employees express interest, we’ll work with your company to launch this innovative program.

Over 18,000 people signed up for Daffy

Frequently asked questions

What are the benefits of donating private stock?

There are several benefits to donating stock, whether from a public or private company, instead of cash. When you donate stock that you have held for more than one year, you can qualify for an immediate income tax deduction at the current fair market value of shares held for more than one year.

When you donate long-term appreciated stock, you also avoid paying capital gains taxes on the appreciation. This is especially beneficial if your stock has significantly increased in value, potentially increasing the amount you have available to donate to charities. Since charities are tax-exempt, they receive the full value of your private stock once liquidated because they don’t pay capital gains taxes.

Unlike stock from public companies, private stock is typically illiquid, meaning that it is difficult or prohibitive to sell your shares. But when you donate private stock, the tax savings can help lessen or even eliminate an expense that would have been paid in cash, preserving your cash or other investments. In addition, if the private stock appreciates significantly in the donor-advised fund before it is sold, you can end up with more money tax-free to recommend as donations to charities you support.

The vast majority of charities don’t accept private or publicly traded stock directly. With Daffy, you can contribute these assets easily and once liquid, donate to nearly any charity, school, or religious institution in the U.S., from one place.

How can people donate if the shares aren’t liquid?

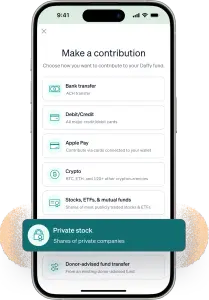

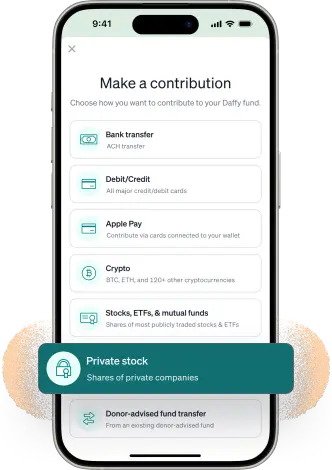

Even if private shares aren’t liquid yet, you can still donate them through a donor-advised fund (DAF) like Daffy. When you donate private stock to Daffy, the shares are not sold. Instead, the ownership of the shares is transferred to Daffy Charitable Fund.

Through Daffy’s Private Stock Donation Program, Daffy will hold your shares until they can be sold or a future liquidity event occurs. Once the shares are sold, the proceeds will be invested in the portfolio assigned to your account and you can begin making donation recommendations. In the meantime, you can add other assets to your fund—cash, stock, or crypto—and start giving immediately.

When should a company run this program?

The Daffy Private Stock Donation Program can be run anytime as a one-time opportunity or as an ongoing program. It is particularly valuable to run after a tender offer or other forms of structured secondary where employees may have an additional tax liability. The Daffy team will work with your company’s finance and benefits teams to manage the process through five simple steps:

- Establish terms and timing with the company.

- Obtain board approval.

- Gather donation interest from employees.

- Transfer the private stock to Daffy.

- Assign the stock to the appropriate member accounts.

What are the other benefits of Daffy for Work?

Daffy for Work offers participating employees access to a modern donor-advised fund with several benefits:

- Simplified & Strategic Giving: Manage all charitable donations in one place, set annual goals, and automate your giving.

- Tax Advantages: Receive an immediate tax deduction for your contributions, even if you distribute the funds to charities later. Donations of appreciated assets like stocks or crypto may also help you avoid capital gains taxes.

- Investment Growth: Funds in the DAF can grow tax-free, potentially increasing the amount you can donate over time. Learn more.

Daffy for Work also offers employers several benefits including:

- Attract and retain top talent: 75% of Millennial employees say it’s important for employers to match employees' charitable contributions. This is why 65% of Fortune 500 companies already offer a corporate giving program. With Daffy, you can effortlessly attract and retain talent by providing them access to a modern giving account.

- Increase employee engagement: Over $4 billion earmarked for employer-giving programs goes unclaimed each year due to the outdated and cumbersome nature of existing programs. Daffy eliminates the need for employees to upload donation receipts and any discomfort with sharing the specific charities they support with their employer.

- Showcase your company’s values: Demonstrate your culture of giving back and avoid alienating employees with centralized giving programs or one-off fundraisers by empowering your employees to give to the organizations that matter most to them.