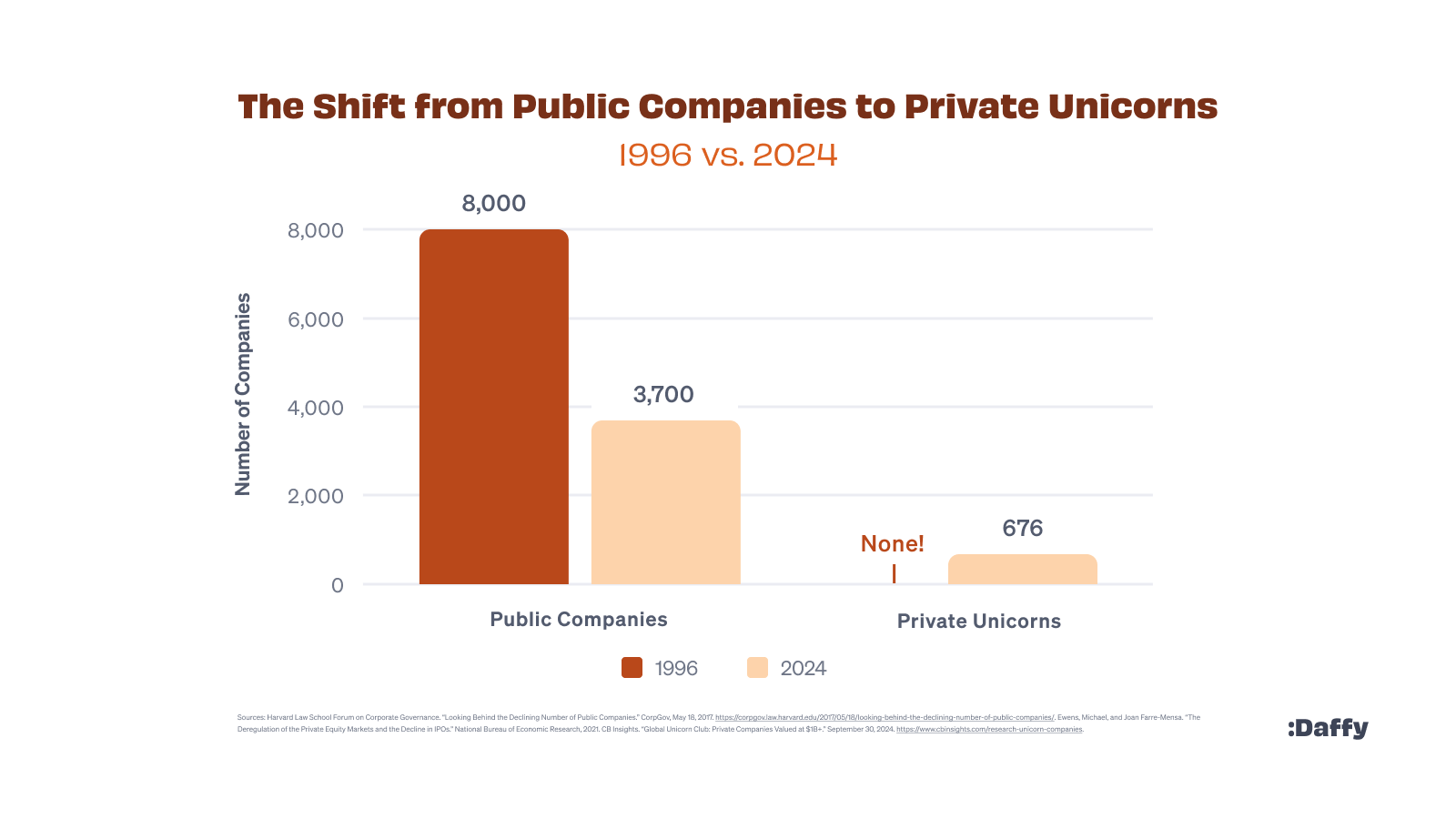

In the wake of the crash of the Internet bubble of the 1990s, the United States rolled out a large number of regulations and requirements to help protect public market investors. In the two decades since that time, not surprisingly, the number of public companies has dropped more than 50%, from just over 8,000 in 1996 to approximately 3,700 today.

Fortunately, the venture-backed ecosystem has not stopped building new companies. But as a result of the higher costs and requirements for becoming a publicly traded company, more and more companies are staying private longer. Not only are companies staying private longer, but they are also growing to unprecedented size. In fact, as of September 2024, the market capitalization of private venture-backed unicorns in the US alone is over $2.2 trillion.

While this is a phenomenal economic achievement, it also has some unexpected and unintended consequences. Hundreds of thousands of employees are now being paid, at least partially, with equity grants of private stock. For the vast majority, this wealth is inaccessible until the company experiences a liquidity event, and as companies stay private longer, those events are becoming fewer and farther between.

High-quality companies have responded to these changes increasingly by arranging tender offers and structured secondary sales to help get their stakeholders access to some liquidity to pay off student loans or purchase a home—but what about philanthropy? Donations of public stock have become a huge source of funding for the 1.7+ million non-profits in the U.S., but what happens when more and more wealth is trapped in private stock?

Today, Daffy is taking a bold step to help unlock that private stock and open up more of that tremendous wealth for charity.

Introducing the Daffy Private Stock Donation Program

In 2023, Daffy unveiled its innovative Daffy for Work platform, which allows companies like OpenAI, Acorns, and Grindr to provide their employees with a simple and effective workplace-giving program based on the vast success of the 401(k).

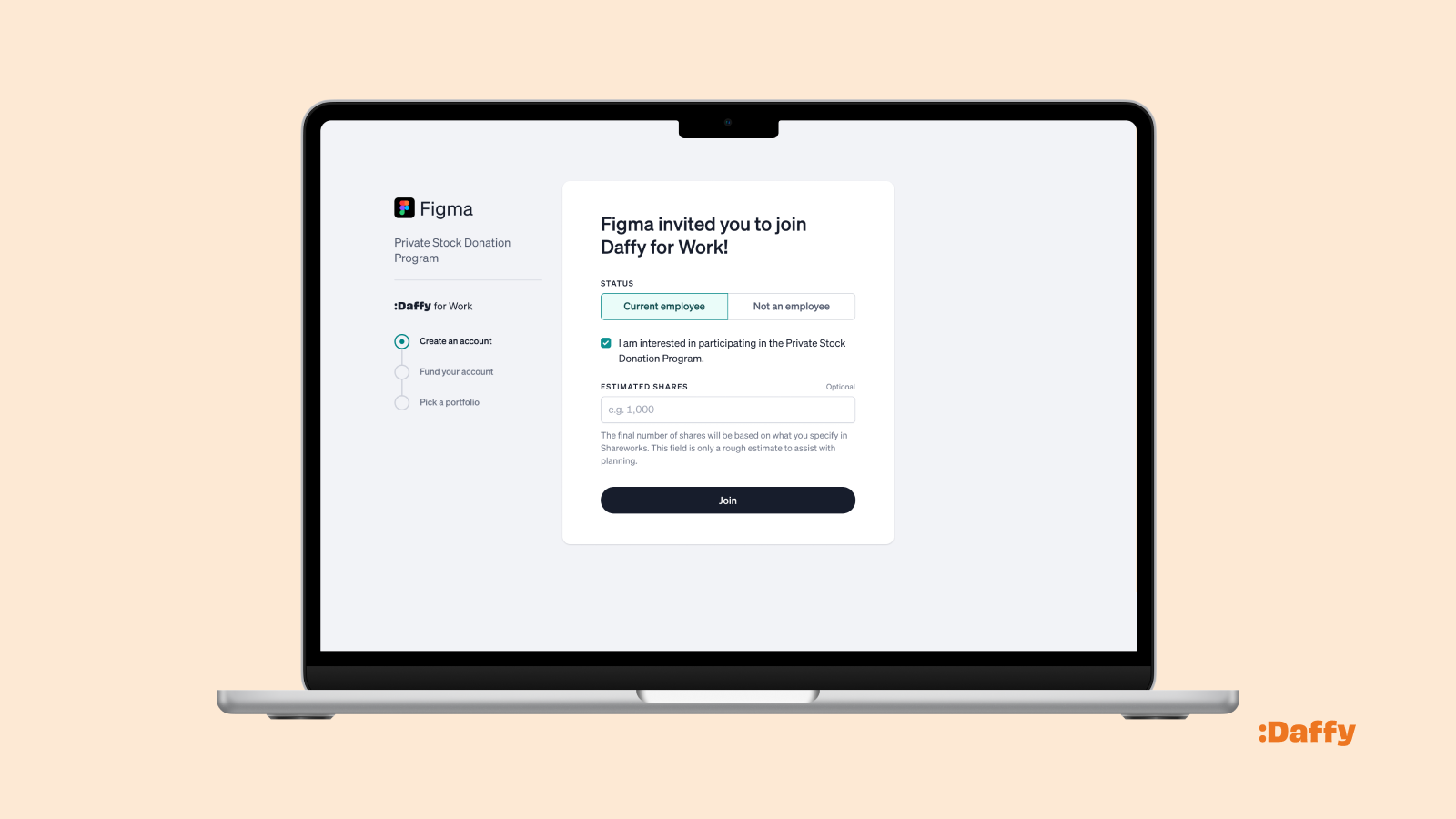

The Daffy Private Stock Donation Program extends that platform to support workplace giving of stock for private companies. Now, employees can make charitable donations of private stock either ad-hoc or after liquidity events like tender offers—making charitable giving accessible to everyone, not just a few well-connected investors and executives.

Not surprisingly, the next generation of companies are leading the way democratizing access to this incredible opportunity for their employees. We’re especially grateful to partner with one of the most successful and forward-thinking private companies, Figma, who recently launched this program for their employees.

Why Private Stock Donations Haven’t Been Accessible—Until Now

The ability to donate private stock is one of those little secrets that has largely been passed down, by word-of-mouth, between experienced founders, investors, and board members for years. There are very few donor-advised fund providers that support private stock, and even fewer charities that can directly accept it.

However, even for the few who learn about this opportunity, the process is complex, expensive, and often gated by high minimums, high legal costs, and high fees. One provider quoted a $1 million minimum donation, and another a minimum fee of $10,000. Most require the donor to pay $3,000 to $5,000 in legal fees upfront. Of course, if that wasn’t enough, many funds charge high annual fees on assets of 0.6% or more in addition to these costs.

Why? For the same reasons that fees have been high across traditional donor-advised funds for decades. Their focus has been primarily on serving the ultra-wealthy, with every transaction a one-off bespoke process that can take up to 12 weeks.

Daffy’s Private Stock Donation Program is different. It leverages modern technology to dramatically improve the user experience and lower costs. More importantly, by working directly with companies, it increases the number of participants, enabling huge cost savings per donor.

Any Daffy member at the Benefactor level can donate private stock, with nothing owed to Daffy upfront. Daffy charges just one simple fee of 1.5% of the value of the stock when it is finally sold.

Giving is truly better when it’s done together.

Great for Companies, Great for Employees

There are many reasons why every private company should implement a private stock donation program for their employees:

- Standardization brings simplicity. Implementing a single program for donating private stock removes the need to handle one-off requests from executives and investors, simplifying the execution of these transactions, and minimizing impact to the cap table. More importantly, it ensures fairness across the organization, by consolidating policy and communication about the opportunity.

- A perfect complement to Tender Offers. If your company has offered or will offer a tender for your employees, the Daffy Private Stock Donation program is the perfect complement. Tender offers bring much-appreciated liquidity for employees and investors, but it also brings a significant taxable event. Donating shares is one of those rare win-wins where the employees benefit from a lower tax bill, and charities benefit from increased funding.

- Maximize charitable impact. Donating private stock allows individuals to contribute the full fair market value of the stock to charity, increasing the total amount given without having to first convert it to cash. Charities also benefit from the tax-free increase in value of the private stock from the time of contribution to the eventual sale of the stock.

- Significant tax savings. Individuals can qualify for an immediate income tax deduction at the current fair market value of shares held for more than one year. Plus, by donating appreciated private stock, individuals get an additional tax benefit by avoiding capital gains taxes on the appreciation.

- A modern workplace giving solution. With a native iOS app and responsive web experience, Daffy makes it easy for employees to contribute additional assets to their accounts, grow those funds tax-free, and give any time they're inspired. Companies that empower their employees to give not only benefit their ability to attract and retain talent, but also benefit from the collective generosity of their teams across their communities.

Bring Private Stock Donations to Your Company

As private companies continue to grow and reshape the economy, the opportunity to unlock billions in charitable giving has never been greater.

Companies like Figma are leading the way, but as more and more companies implement liquidity programs like tender offers and structure secondary programs, they should also enable the flow of some of that wealth to charity. Daffy’s Private Stock Donation Program offers a simple and elegant solution.

Learn more about unlocking private stock for charity and supporting employees through the Daffy Private Stock Donation Program.

If you're an employee at a private company planning a tender offer, or if you are interested in seeing this at your workplace, add your name to our list—if 20 or more employees express interest, we’ll help your company launch the program.

Daffy is the Donor-Advised Fund for You©

Join us.