In 1993, SPDR S&P 500 ETF Trust (Ticker: SPY) became the first ETF to go live in the United States. Since then, ETFs have come to dominate financial news, and have collected over $9.6 trillion in assets. As a result, it’s not surprising that many investors have been wondering what to do with their existing investments in traditional mutual funds. However, for long-term investors, many mutual fund holdings have accrued significant capital gains, making it hard to sell those shares without triggering a large tax bill.

Well, there is good news for mutual fund investors. You can put those gains to good use, tax-free, by donating your mutual fund shares to charity. And while most charities cannot accept mutual fund donations directly, Daffy is here to help.

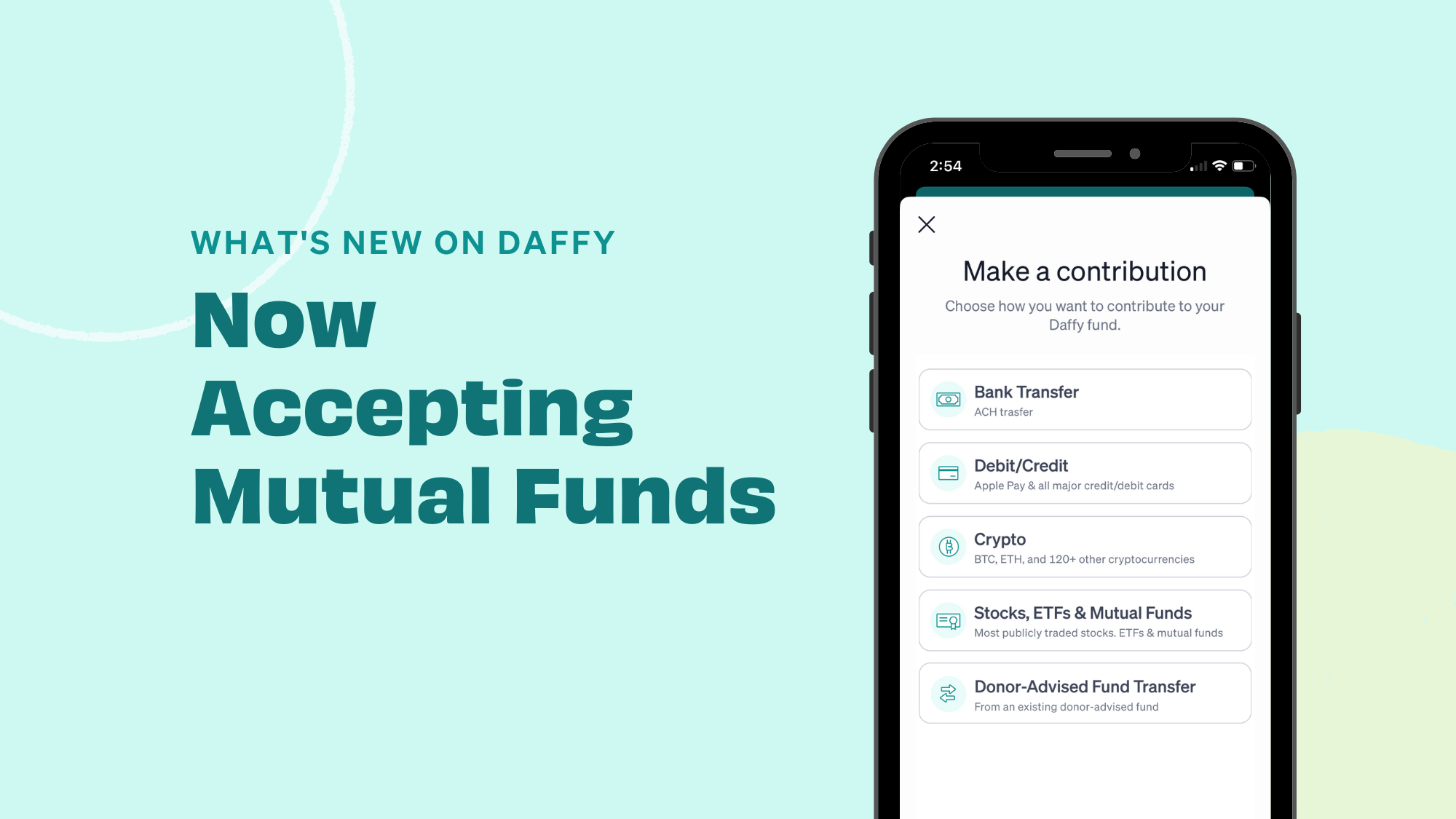

Today, we’re pleased to announce that we now accept mutual fund contributions on Daffy, so that you have more ways to contribute to your fund and maximize your charitable giving.

Now Accepting Mutual Funds

As always, Daffy exists to help our members be more generous, and as a result, we try to make donating any type of asset simple and easy. Members can now contribute mutual funds to their Daffy accounts in just 3 steps:

- Tap “Add Funds,” select “Stocks, ETFs & Mutual Funds,” and let us know which securities you’ll be contributing.

- Initiate a transfer from your brokerage. You can follow our general guide and/or see specific brokerage instructions for Fidelity, Vanguard, Schwab, E-Trade, and Merrill.

- That’s it! We’ll notify you when the security is liquidated and added to your fund balance. Timing depends on your brokerage firm.

The Benefit of Donating Mutual Fund Shares

When you donate appreciated securities held for more than a year, you not only get the charitable donation deduction for the current fair market value of the security, but you will never owe the capital gains taxes on those investments. Plus, because the charity is an exempt organization, they don’t have to pay capital gains taxes either.

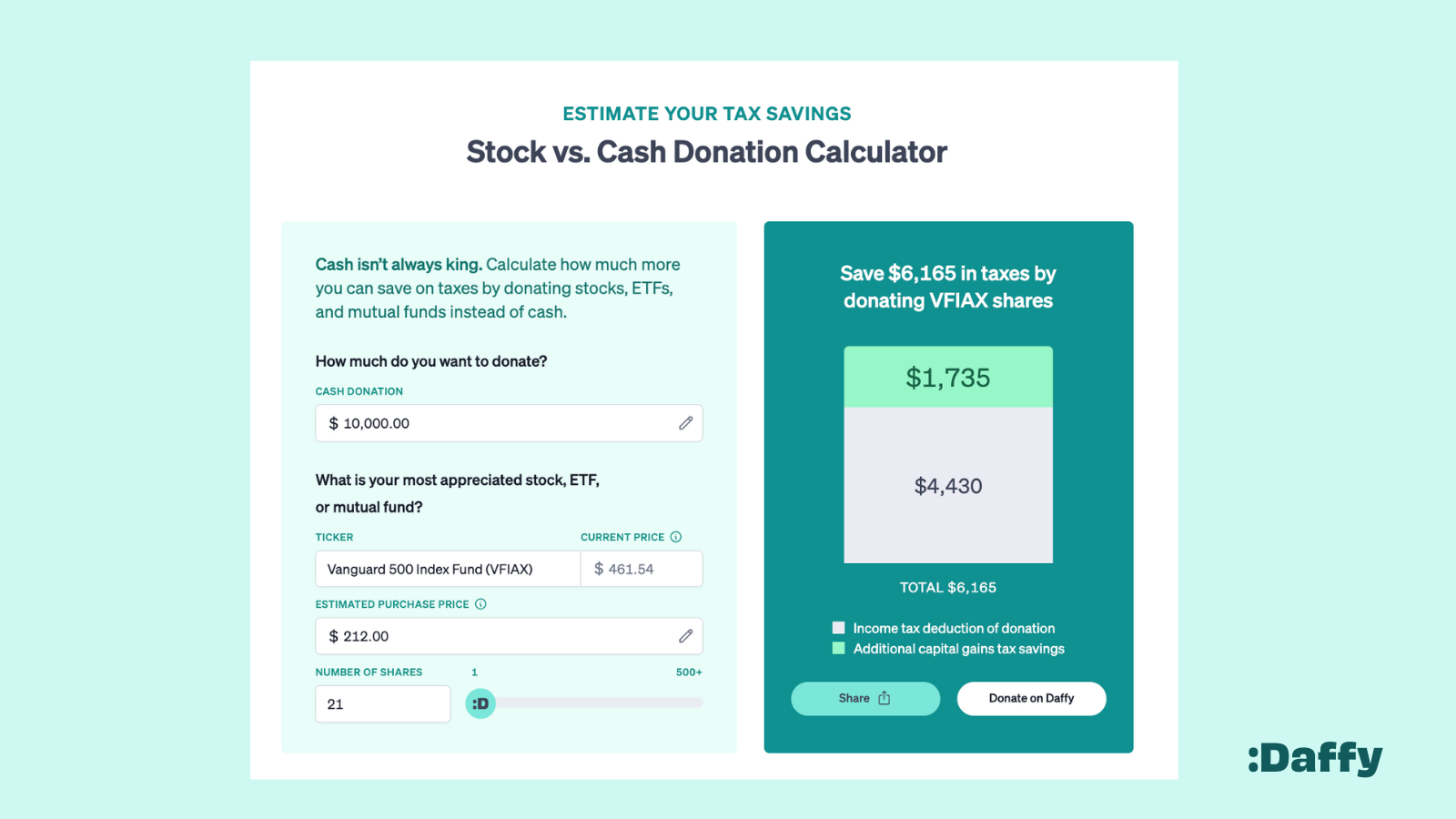

There’s no better way to explain the benefit of donating appreciated securities than by running through a simple example of how you can save thousands of dollars in taxes by donating appreciated assets instead of cash.

Imagine a person who regularly gives $10,000 per year to various charities. Unfortunately, they don’t know the benefits of donating appreciated assets so instead they donate cash. Assuming a Federal tax rate of 35% and a California tax rate of 9.3%, they will get a tax deduction of up to $4,430 for that donation.

However, if they donate an appreciated security, they could save thousands of dollars more. Let’s say they had the good fortune to have invested in the Vanguard 500 Index Fund (VFIAX) years ago at $212 per share, and today it’s trading at $461.54. If they donated 21 shares of VFIAX instead, they would not only get the same charitable deduction as donating an equivalent amount of cash, but they would also avoid paying the $1,735 they would owe if they sold the shares instead.

Less Money in Taxes & More Money for Charity

More and more people are discovering the benefits of funding their charitable giving with investments like stocks, ETFs, and mutual funds. Just last month, we released our 2023 Year in Review highlighting many areas of growth for our community including how contributions from Daffy members grew by 425% to over $105 million set aside for charity. In 2023, stock contributions grew by over 2,960%!

Daffy was designed for this to happen. We hoped that by building a platform that was affordable for donors of all sizes and that by making donating stocks, ETFs, and mutual funds from various brokerages as easy as filling up your Amazon cart that donating appreciated assets would be something any investor could do.

Check out our free calculator that lets you estimate the tax savings for donating any publicly traded stock, ETF, or mutual fund vs. cash. You’ll be shocked at how much farther your money can go for the charities and causes you support.

Put those traditional mutual fund investments to good use and save money on taxes. What could be a better way to kick off a generous new year. 🙏

Assumptions that were used above: To simplify this example for educational purposes, the analysis rounds the number of shares of Apple stock to the nearest whole number, from 109.36 to 109. This tax estimate is based on a marginal federal income tax rate of 35% and a California marginal state tax of 9.3% as well as capital gains taxes of 20% on federal taxes, 9.3% on state taxes, and 3.8% Medicare tax. Please note that the information is for educational purposes only and should not be considered tax advice. Any calculations are intended to be illustrative and do not reflect all of the potential complexities of individual tax returns. To assess your specific tax situation, please consult with a tax professional.