Giving through donor-advised funds (or DAFs) comes with a lot of benefits, including immediate tax deductions for your charitable contributions, investing your charitable dollars tax-free, and avoiding capital gains tax by directly donating appreciated stock, ETFs, or crypto.

Unfortunately, there’s a catch. Most donor-advised funds charge high fees, and if you’re not careful, hidden fees from traditional providers will shrink the value of your donor-advised fund.

Let’s look at Daffy’s membership model compared to three of the largest traditional donor-advised fund providers in the U.S.: Fidelity, Schwab, and Vanguard. The big reveal is below, but the punchline is simple: You will save as much as 77% or nearly $1,000 on a $100,000 account by opting for Daffy over other donor-advised fund providers.

Types of Donor-Advised Fund Fees

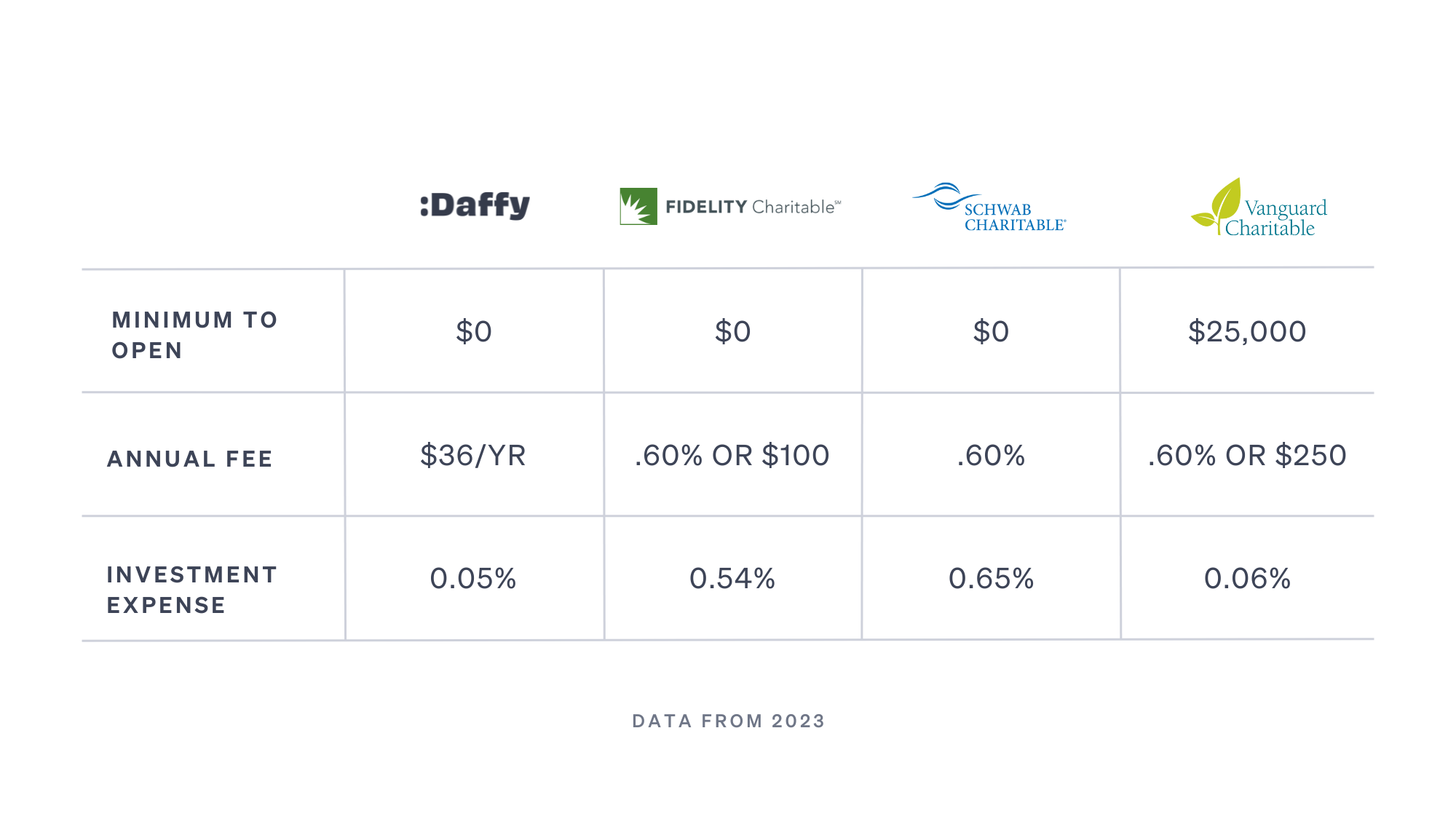

Just as with any other tax-advantaged investment account like your 401(k) or IRA, donor-advised funds typically come with different fees associated with administering the account and managing your investment choices. But not all donor-advised funds are created equally. There is a huge difference in how much you’ll pay each year depending on which provider you use. Here’s a breakdown of what to look for when comparing your options.

Annual administrative costs

An administrative fee is an ongoing fee that’s often charged for each donor-advised fund account on an annual basis. Many donor-advised fund providers charge this fee as a percentage of your assets under management, or AUM. They usually have a tiered fee structure with a lower fee for larger account balances, but no matter what size your account is, the fee is still based on a percentage of assets. That’s the problem. This structure is a lose-lose for everyone except the donor-advised fund provider, especially when your goal is to support causes and charities you care about.

Here’s why:

- The fees are hidden. These administrative fees are often taken silently out of the fund balances with little or no communication. Many DAF holders don’t even know how much they pay every year for their fund, so if you’ve got a DAF be sure to check to see what you’re paying for it. Most people are floored to find out they are paying thousands of dollars per year for their account.

- Account minimums and minimum fees are too high. First of all, with Vanguard, you can’t even open a DAF account without having $25,000, and then they charge a minimum annual fee of $250. And while Fidelity doesn’t have a minimum amount required to open a DAF account, the annual administrative fee starts at 0.60% or $100, whichever is greater, meaning that if you’re just starting out with a $5,000 fund, you’ll be charged $100 per year!

- AUM fees mean DAF providers lose revenue when you give. The AUM pricing structure means that institutions lose revenue when you give. For example, if you have a $100,000 fund with Fidelity, and you decide to give $10,000 away to charity, Fidelity loses 10% of their revenue. That’s a powerful incentive for them to help you accumulate assets, but a strong disincentive for them to see assets donated to operating charities.

Daffy addresses these issues with a transparent and simple structure that benefits accounts of all sizes, plus the charities you’re trying to help. Like many not-for-profit organizations, Daffy charges flat and low-cost monthly membership dues starting at just $3/month. With Daffy, there’s no incentive for us to keep your cash in your fund instead of putting it to good use in the hands of your favorite charities. Plus, Daffy waives membership fees for members with less than $100 in their fund, so that more people have access to this tax-advantaged charitable giving account.

Investment fees

While the administrative fees or membership dues are for covering the costs of managing the account, you'll also see fees that cover the costs of managing your investments. When you invest in an ETF, you might see this called an expense ratio. Donor-advised fund providers publish the annual percentage fee for each investment option available, and the cost usually depends on the types of investments held in your chosen portfolio.

Daffy has 13 different portfolios that cater to different risk levels and investment preferences, which include cash, inflation-protected bonds, equities, bonds, and even crypto. Plus, unlike some DAF providers, we do not charge an additional management fee for investment portfolios, we simply pass through the low-cost expense ratios of our providers, which range between 0.04% and 0.17%.

As you’ll see below, even when we look at balanced portfolios offered by Fidelity, Schwab, and Vanguard, Daffy’s expense ratios are exceptionally low.

Transfer your DAF to Daffy and start saving today.

Daffy vs. Traditional Donor-Advised Funds

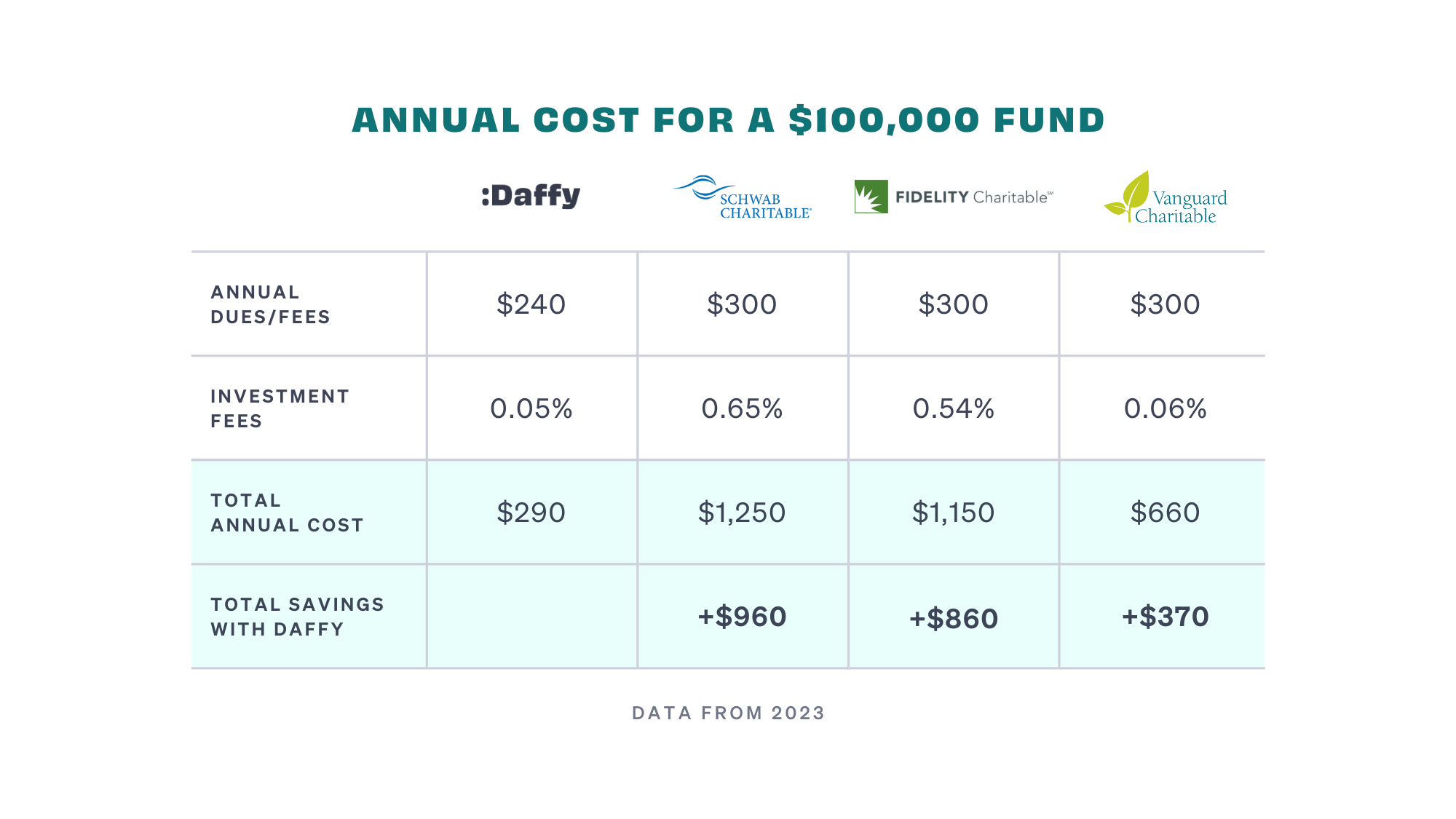

Let’s take a look at our side-by-side comparison of Daffy versus Fidelity, Schwab, and Vanguard for a $100,000 fund, so you can see how over time these hidden and AUM-based fees can really add up.

The annual cost of a $100,000 fund

Daffy wins against the competition in terms of both annual dues/fees and investment fees. The monthly membership structure clearly beats out the traditional assets under the management fee structure. And Daffy’s portfolio expense ratios are much lower than similar options from other donor-advised fund providers.

Here’s an estimated rate of savings you can expect when choosing Daffy for your donor-advised fund.

- Daffy vs. Schwab: 77% savings rate

- Daffy vs. Fidelity: 75% savings rate

- Daffy vs. Vanguard: 56% savings rate

Over ten years, you could save up to $9,600 in fees by choosing Daffy instead of a traditional donor-advised fund.

Why choose Daffy?

Whether you’re just opening a donor-advised fund or are ready to make the switch from an existing donor-advised fund provider, Daffy is a great choice.

In addition to lower annual costs, Daffy comes with a host of benefits you won’t find with other donor-advised fund providers. Here’s what else you can expect when you choose to give through Daffy:

- You pay one flat monthly membership fee. No hidden AUM fees.

- We have a portfolio for everyone. Daffy offers 13 different portfolios with a variety of risk levels and investments, including cash, inflation-protected bonds, equities, bonds, and crypto. Plus, the expense ratios are exceptionally low.

- You don’t have to maintain a minimum account balance requirement. Give at your own pace.

- You can contribute and invest in crypto.

- You can involve your family in your giving. With Daffy for Families, your kids, siblings, or other family members can help make a difference right alongside you.

- We have a full-featured mobile app. Send donation recommendations quickly from your phone whenever you feel inspired.

Download the app or visit Daffy.org to open your account. Then choose how you want to fund it: debit or credit card, bank transfer, or using a stock or crypto transfer. You can also transfer an existing DAF by following these steps.

For anyone who uses a DAF, I've tried using @DaffyGiving and it has been a very good experience. It's simple to transfer funds to it (you just donate to it from current DAF) and the check minimum is much lower. Recommend.

— james hong (@jhong) February 21, 2023