This piece was originally published on Benzinga on November 9, 2023.

If you are not the type of person who donates money to charity, then you can skip this article. But if you are one of the 60 million American households who give to charity every year, there’s some bad news. You probably have been donating cash to charities and paying more than you need to in taxes every year.

Whether it is your children’s school, your place of worship, your alma mater, or a national cause-based charity, if you are using your bank account or credit card to make a donation, you are leaving money on the table.

The good news is, there is an easy way to solve this problem and save money on your tax bill. Donate stock (or mutual funds or ETFs) instead of cash to charity.

The Tax Benefits Of Donating Stock To Charity

When you donate to a charity, the IRS provides an amazing tax benefit. As long as the donation is to a qualified institution, you can deduct the full value of that donation against income. It’s one of the most generous deductions in the tax code.

This is true whether you donate cash or stock, but when you donate appreciated assets, there is an additional benefit.

Not only do you get to deduct the current market value of the security, but you also never have to pay capital gains taxes on that security. This applies to any security that you have held for more than one year (long term) where you have a gain over the price you paid for the security.

The charity, of course, benefits too. If you sold the stock, you would have to pay the capital gains taxes, and you would have less money to give to the charity. When you donate the stock, the charity sells it, but because they are an exempt organization, they don’t have to pay capital gains taxes.

Running The Numbers

Let’s run through a simple example to illustrate how you can save thousands of dollars in taxes.

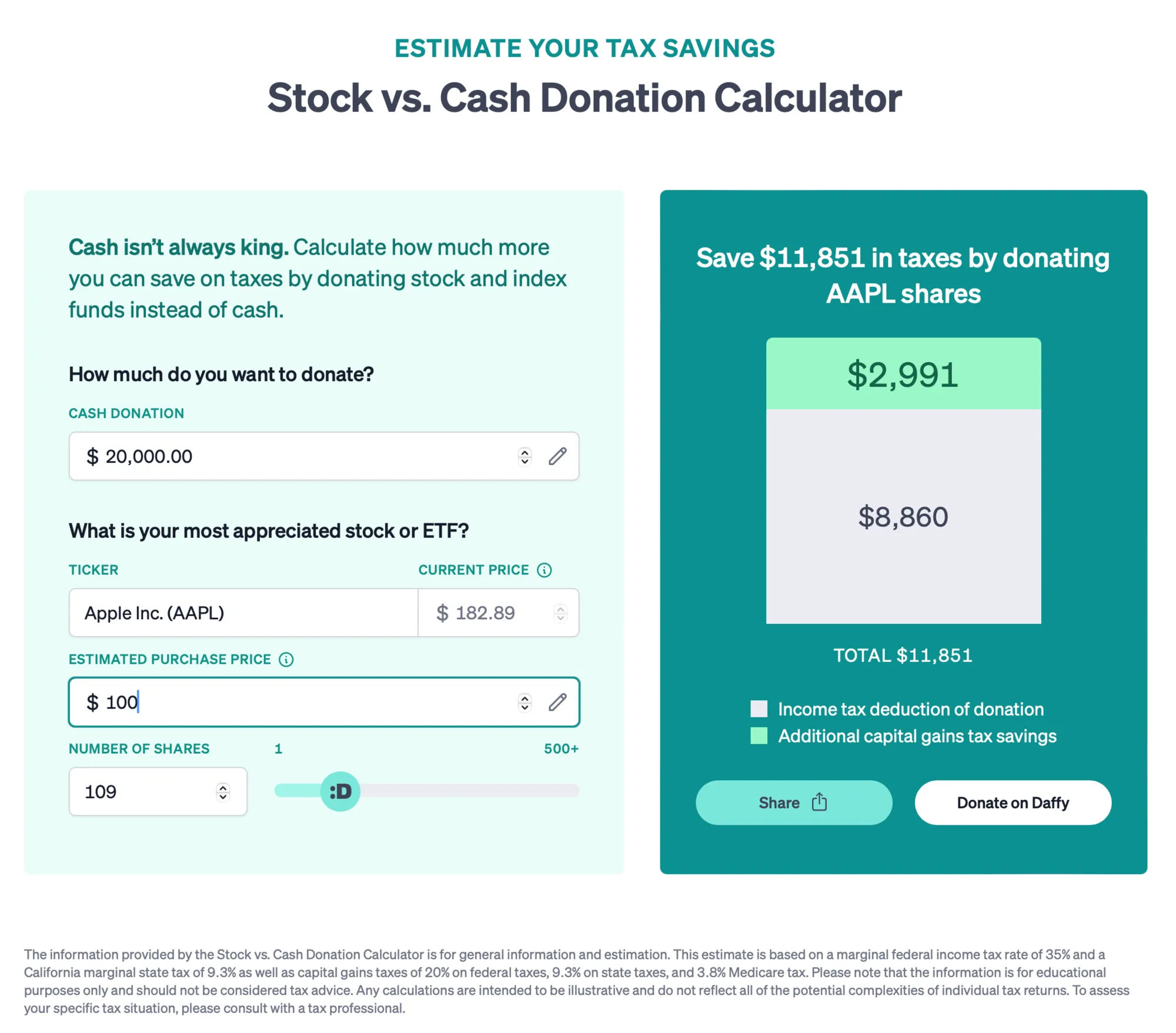

Imagine a person who regularly gives $20,000 per year to their children’s school. Unfortunately, they don’t know the benefits of donating stock, so instead they donate cash. Assuming a Federal tax rate of 35% and a California tax rate of 9.3%, they will get a tax deduction of up to $8,860 for that donation.

However, if they donated stock, they could save thousands of dollars more. Let’s say they had the good fortune to have purchased Apple stock years ago at $100 per share, and today it’s trading at $182.89. If they donated 109 shares of Apple stock instead, they would not only get the same charitable deduction as donating an equivalent amount of cash, but they would also avoid paying the $2,991 they would owe if they sold the stock instead.

In fact, if they still believe in the future of Apple stock, they don’t really have to give up that projected growth. Just use the $20,000 in cash that you would have given to the school, and use it to buy back the 109 shares of Apple. Their cost basis is now $182.89, and their portfolio will still benefit from any growth in Apple shares.

These tax benefits don’t just apply to stock. Any appreciated security has the same treatment, whether it is a stock, a mutual fund, an ETF, or even crypto. If you have shares of an index fund, like Vanguard Total Market that you’ve held for 10 years, you can donate those shares as well!

Daffy has a free, simple calculator that lets you calculate the tax savings for donating any publicly traded stock or ETF vs. cash.

Donor-Advised Funds Make It Simple To Donate Stock

There are two problems, however, that come up when you try to donate securities to charity.

The first problem is that most charities don’t accept securities as donations. In fact, out of the more than 1.7 million charities in the US, only a few thousand do. The second problem is that most people do not want to give all of their securities to a single charity in a single year. Fortunately, donor-advised funds (like Daffy) solve both of these issues.

A good donor-advised fund lets you donate stock anytime and qualify immediately for a charitable tax deduction. The proceeds of the sale of the stock are invested, tax-free, in a portfolio that you select, and then anytime you want to make a donation to an operating charity, you make a simple recommendation. The fund then sends the money to the charity. It’s really that simple.

If you have never heard of a donor-advised fund, you are not alone. To date, they have mostly been marketed to wealthy clients through advisors and high-end accountants.

That is why I spoke about donor-advised funds (DAFs) at Benzinga’s Fintech Deal Day on Nov.13 as part of their Fintech Innovations for Underserved Markets panel.

DAFs have been around for decades, and are rapidly growing in popularity as a tax-advantaged account for charity. Not only are there over 1.2 million DAF accounts in the US now, but they have grown by an average of 28.5% per year since 2017.

Unfortunately, most donor-advised funds have high minimum balances and even higher fees, but there are now modern, low-cost options like Daffy.org that charge as little as $3 per month.

So if you are a generous person who gives to even one charity every year, think carefully next time about donating cash. You can feel good about saving money on taxes and being more generous just by donating stock instead.

Assumptions that were used above: To simplify this example for educational purposes, the analysis rounds the number of shares of Apple stock to the nearest whole number, from 109.36 to 109. This tax estimate is based on a marginal federal income tax rate of 35% and a California marginal state tax of 9.3% as well as capital gains taxes of 20% on federal taxes, 9.3% on state taxes, and 3.8% Medicare tax. Please note that the information is for educational purposes only and should not be considered tax advice. Any calculations are intended to be illustrative and do not reflect all of the potential complexities of individual tax returns. To assess your specific tax situation, please consult with a tax professional.